Breaking the Bottleneck | Issue 13

[06/5/2023] 2023 3D Printing & OT Cyber Reports, Additive Manufacturing Consolidation

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, and a startup database. For a high-level market map on discrete and continuous manufacturing click the link here! If you know anyone looking to chat about manufacturing tech, I’d love to talk!

Content I Enjoyed This Week 🏭🗞️🔬

News:

3D Systems Confirms Bid to Buy Stratasys [3DPrint]

The article discusses recent developments in the 3D printing industry, particularly regarding the companies Stratasys and 3D Systems. Stratasys had previously announced plans to merge with Desktop Metal, but now 3D Systems has made an unsolicited bid to acquire Stratasys. 3D Systems CEO Jeffrey Graves believes that combining the two companies would be highly beneficial for their shareholders, employees, and customers. Stratasys, however, has chosen a different path and announced a $1.8 billion all-stock transaction to merge with Desktop Metal. This merger would bring together a large polymer-based 3D printing firm with a pioneer in metal 3D printing. The CEOs of both companies expressed optimism about the merger and its potential to drive the next phase of additive manufacturing for mass production. While 3D Systems made a lower bid for Stratasys, they are still awaiting a response, and the Desktop Metal deal is expected to close in the fourth quarter.

FDA Offers Funding for Advanced Manufacturing Tech [MedTech Intelligence]

The FDA is offering funding to medical device manufacturers through the Advanced Manufacturing Clearing House (AMCH) program, in partnership with the Medical Device Consortium (MDIC). The program provides funding for up to 30% (maximum $300,000) of total project costs to accelerate the adoption of advanced manufacturing technologies in the medical device industry. Companies can apply regardless of their size or years in operation, with a focus on implementing technologies like artificial intelligence and virtual reality. Successful applicants receive partial payments based on project milestones, with full payment upon completion, and are encouraged to share their learnings with the industry.

Biden Administration Announces Indo-Pacific Deal [NY Times]

The Biden administration has reached an agreement with 13 countries in the Indo-Pacific region to coordinate supply chains, aiming to reduce dependence on China for critical products and enhance resilience against crises. The supply chain agreement is part of the Indo-Pacific Economic Framework, the administration's trade initiative. However, concerns have been raised by business groups about the deal, as it excludes traditional U.S. trade priorities, such as lowering tariffs and establishing stronger intellectual property protections. The administration argues that past trade deals with such provisions have hurt American workers, while business leaders worry that regulatory barriers and the absence of digital trade rules may undermine the effectiveness of the agreement.

US FDA Uncovers Failures in India Pharma Factories [Bloomberg]

US inspectors have recently discovered various deficiencies at factories operated by major Indian pharmaceutical firms, highlighting lapses in manufacturing practices and quality control. The US FDA issued notices and warning letters to dozens of drugmakers, citing unsanitary conditions, poorly trained staff, shredded paperwork, under-investigated customer complaints, and evidence of exporting contaminated drugs to the US. These lapses, revealed in FDA records obtained under the Freedom of Information Act, indicate that the absence of factory audits during the COVID-19 pandemic allowed faults to go unnoticed in some Indian plants that export drugs to the US. India, the largest supplier of generic drugs to the US and many other countries has faced increased scrutiny following manufacturing incidents and scandals involving smaller Indian companies. The FDA's concerns have affected Indian pharmaceutical stocks, and there are calls for stricter oversight and a reassessment of global supply chains. The Biden administration has expressed concerns about drug supplies from countries like India and is advocating for increased domestic production. India's pharmaceutical sector, valued at $50 billion, is crucial for the country's economy and its reputation as a manufacturing alternative to China. However, the FDA's ongoing warnings and recalls highlight the need for improved manufacturing practices and regulatory compliance within the Indian drug industry.

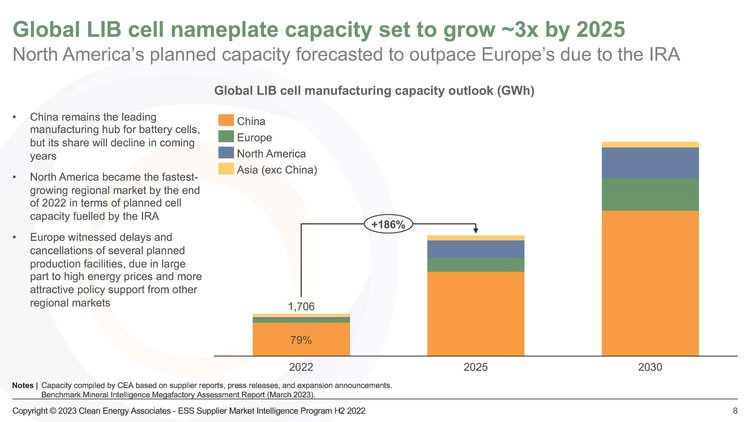

NA Is Now The Fastest-Growing Battery Manufacturing Hub [InsideEVs]

The CEA report states that North America became the fastest-growing regional market for planned battery cell manufacturing by the end of 2022. The report also =projects global battery cell manufacturing to grow 186 percent, or three times, by 2025.

Research/Blogs:

2023 3D Printing Trend Report [Protolabs]

Here are some of the key findings:

The overall 3D printing market will grow by 17% to reach $19.9 billion in 2023.

71% of businesses surveyed used 3D printing more in 2022 than in 2021.

83% of respondents believe 3D printing helped them save substantial costs in their manufacturing pipeline.

56% of survey participants named FDM the most frequently used additive technology.

For 47% of businesses, 3D printing covered 0-20% of overall manufacturing requirements.

76.24% of businesses produced 10+ parts in their production runs, up from 49% in 2021.

2023 AT&T Cybersecurity Insights Report: Edge Ecosystem

Here are some great insights on the enterprise edge infrastructure in manufacturing:

Across all edge types, the majority of survey respondents (56%) consider themselves in partial implementation.

Industrial IoT/OT is the leading edge type (65.4%), followed by IaaS/PaaS/SaaS cloud data center (60.4%).

On-premises private cellular 5G is the leading edge network connectivity (77.1%).

Personal computers are the leading endpoint type (48.1%), followed closely by mobile devices (47.8%).

DDoS edges out business email compromise and personal information exfiltration as the most likely perceived threat for primary use cases (mean rating of 3.03 on a scale of 1 to 5).

The firewall at the network edge continues to be perceived as delivering the most significant cost benefit (38.6%).

Anticipated edge use case investments are relatively balanced across the strategy/ planning (23.4%), network (29.8%), security (22.0%), and application (21.7%) categories.

Podcasts/Video:

This Is How We'll Know If the CHIPS Act Is Working [Odd Lots]

Stratasys and Desktop Metal to Merge [Printing Money]

Twitter:

Manufacturing Deals

Fortify - A company combining magnetics and DLP (digital light processing) to produce custom microstructures in high-resolution 3D printed composite parts.

$12.5 million [Series A] - Led by Lockheed Martin and Raytheon

Realta Fusion - A spin out from the University of Wisconsing developing the lowest capital and least complex path to commercially competitive fusion energy.

$9 million [Series Seed] - Led by Khosla Ventures

Galvanick - A company offering an Extended Detection & Response (XDR) platform for industrials.

$10 million [Series Seed] - From MaC Venture Capital, Founders Fund, Village Global, and Countdown Capital

Squint - A company building an AR-powered interface and app-based accessibility for factory's procedures and workforce optimization

$6 million [Series Seed] - From Sequoia Capital and Menlo Ventures

Riverse - a Paris-based carbon measurement, verification and monetization platform for the European industrial sector

$1.6 million [Series Seed] - Led by Speedinvest and joined by Techstars Berlin, Evolem, and other angels.