Breaking the Bottleneck | Issue 23

[8/21/2023] Manufacturing Market Map, Lots of Funding, Generative AI in Manufacturing

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, and a startup database. For an older version of a discrete and continuous manufacturing market map click the link here!

Content I Enjoyed This Week 🏭🗞️🔬

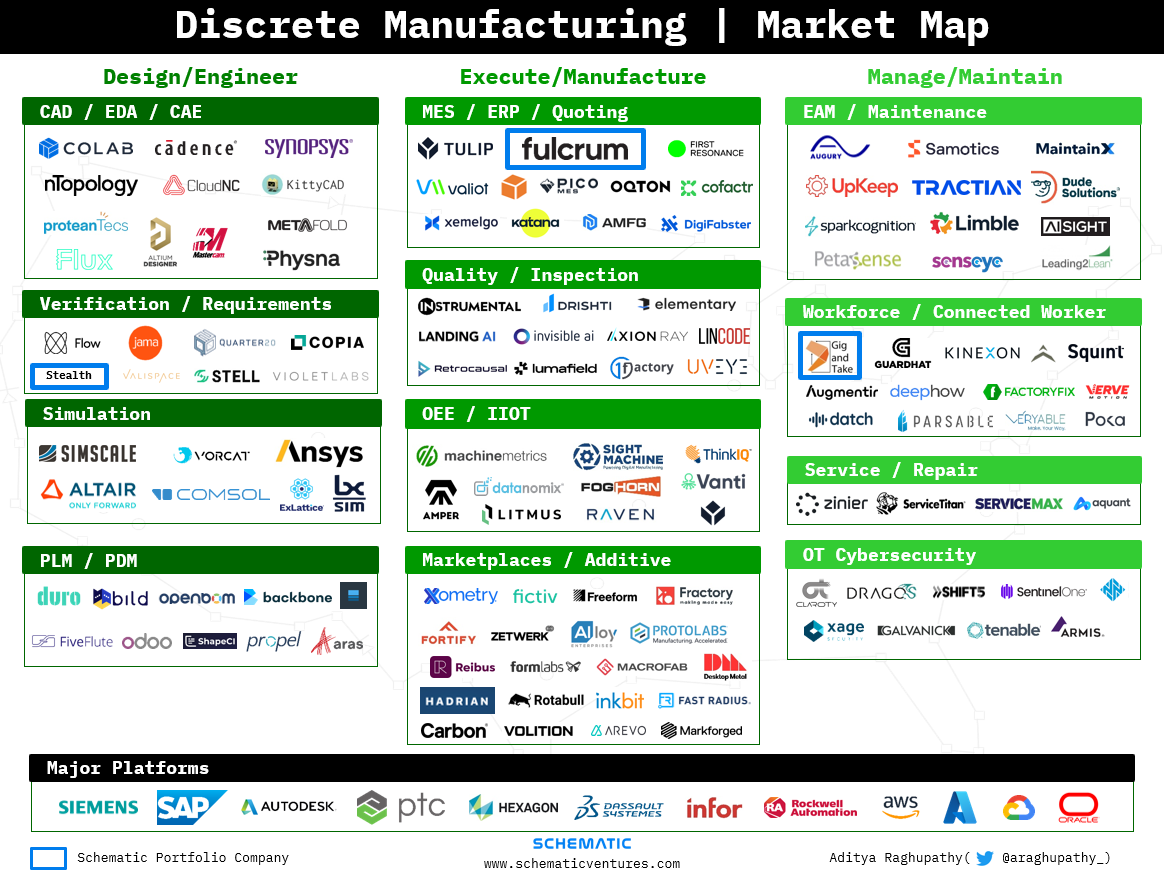

Discrete Manufacturing Market Map Update!

An updated continuous market map is coming out next week!

News:

Apple Using Metal Binder Jetting for Apple Watch [Voxel Matters]

Apple is reportedly testing metal binder jetting technology to manufacture watch cases in steel and titanium for the production of the Apple Watch Series 9. The company may be partnering with various 3D printer manufacturers depending on where the watches will be manufactured, with the US and Asia being potential locations. Desktop Metal and HP are among the leading candidates for US production. If production occurs in Asia, Apple may collaborate with local 3D printer manufacturers like EasyMFG, which has demonstrated 3D printed titanium watch casings using binder jetting technology. Additionally, Foxconn, Apple's current manufacturing partner in Asia, has been working with Triditive to develop a metal binder jetting technology, specifically designed for high-speed printing of metal parts, which could be suitable for the Apple Watch cases.

Honeywell Acquires SCADAfence [VentureBeat]

Honeywell has acquired SCADAfence, an Israeli-based provider of OT and IoT cybersecurity solutions to deliver an integrated platform to manufacturers, process industries, and infrastructure providers, focusing on areas like asset discovery, threat detection, and compliance management. Honeywell's acquisition of SCADAfence reflects the industry's growing awareness of the need to close cybersecurity gaps and protect against cyber threats, especially in the OT and IoT domains. The IBM Security X-Force Threat Intelligence Index found that manufacturing is the most attacked industry globally, accounting for 23% of all ransomware attacks last year.'

New $15.5 Package to Retrofit Existing Automotive Manufacturing Facilities

The DOE will provide $2 billion in grants and up to $10 billion in loans to support automotive manufacturing conversion projects that aim to transition existing factories to manufacture electric vehicles and components. These projects will focus on producing efficient hybrid, plug-in electric hybrid, plug-in electric drive, and hydrogen fuel cell electric vehicles, covering light, medium, and heavy-duty electrified vehicles and components. An additional $3.5 billion will be offered for battery manufacturing and battery materials critical for clean energy industries, including electric vehicles and energy storage. This funding will support the creation and expansion of domestic commercial facilities for battery materials, battery components, and cell manufacturing. Finally, up to $10 billion in loan authority will be made available for automotive manufacturing conversion projects that retain high-quality jobs in communities hosting manufacturing facilities.

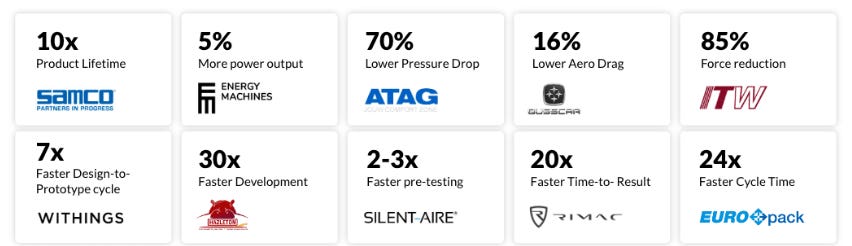

How Cloud-Native CAE Simulation Boosts Growth & Savings [SimScale]

Cloud-native simulation leverages cloud computing to execute complex engineering simulations quickly and efficiently, revolutionizing product development. It allows engineers and designers to access high-performance computing resources and offers top-line growth benefits, such as improved product performance faster time-to-market, and bottom-line savings, including lower engineering and R&D costs, reduced costs of goods sold (COGS), and improved profitability.

Synopsys Launches AI Tools for Chip Design [Forbes]

Synopsys has launched a new platform called Synopsys EDA Data Analytics Solution, which aims to streamline the chip design workflow using artificial intelligence (AI). This platform integrates data across the IC design, testing, validation, and manufacturing processes, enabling cross-domain analysis and improving chip design productivity. It uses AI-driven data analytics to connect issues discovered during testing or validation to their root causes in architecture or manufacturing, speeding up design closure and reducing project risk. This solution is the first of its kind in the semiconductor industry to provide AI-driven insight and optimization across the entire chip design process, from exploration to manufacturing.

Research:

How can LLMS Help in Design and Manufacturing? [MIT]

A great research paper from MIT focusing on evaluating the applicability of LLMs across generating a design, constructing a design space and design variations, preparing designs for manufacturing, evaluating a design’s performance, and discovering high-performing designs based on a given performance and design space.

Global Supply Chains: The Looming “Great Reallocation [KC Fed]

Great paper providing a comprehensive analysis of the “great reallocation” of US supply chain activity. This shift is marked by a decline in direct US sourcing from China, with a corresponding rise in import share from low-wage locations, chiefly Vietnam, and regional trade areas, particularly Mexico. While US imports have become more upstream in their production line positioning, suggestive of the reshoring of production stages, the economic activity data presents a more nuanced picture. The semiconductor sector, for example, has shown a resurgence post-2021, while other sectors display changes that either precede 2017 or have yet to regain a loss in overall market share. The paper also highlights that recent policy efforts may ultimately not succeed in their objective to reduce US dependence on supply chains tied to China. Despite a decrease in US direct reliance on China, there has been an increase in China’s import share in “friendly” nations, including the EU, Mexico, and Vietnam. And, although China is unlikely to circumvent policy via FDI (as Japan did in the 1970s and 1980s), Chinese firms are stepping up FDI and production facilities in Vietnam and Mexico in critical sectors. This suggests that plants in which China is the ultimate owner may continue to play a significant role in US value chains.

Podcasts:

Industry 4.0 Lessons from the US Navy[Manufacturing Happy Hour]

Exploring Foundational Model Use Cases in Manufacturing [AI in Business]

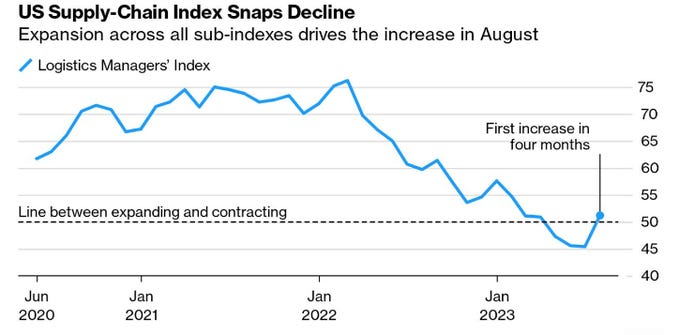

Chart of the Week:

US logistics activity expanded in August, snapping three months of contraction. “It is not yet clear whether this move back towards expansion is a one-off deviation from the contraction we had been seeing or represents a pivot back towards expansion remains to be seen.”

Manufacturing Deals

Fulcrum - A ERP, MRP, and MES platform allowing small and mid-sized manufacturers to improve efficiency through workflow optimization and automated data collection

$18 million [Series A2] - Led by Bessemer Venture Partners and joined by Battery Ventures, Motivate Venture Capital, & Schematic Ventures

Accure - A German company building a product to improve the safety, reliability and longevity of battery systems

$7.8 million [Series A] - Co-led by Bear Capital and HSBC Asset Management and joined by Capnamic Ventures

Cellares - The first Integrated Development and Manufacturing Organization (IDMO) for cell therapy manufacturing

$255 million [Series C] - Led by Koch Disruptive Technologies and joined by Bristol Myers Squibb, DFJ Growth, & Willett Advisors

Cascade Biocatalysts - A company creating more productive enzymes for the economical biomanufacturing of sustainable chemicals

$2.6 million [Pre-Seed] - Led by Ten VC and joined by Amplify.LA, Boost VC, & Range Ventures

Aperio - A company automatically validating industrial operational data at scale to improve data accuracy, security, and value

$9 million [Series A] - Led by Momenta and joined by Chevron Technology Ventures, NextEra Energy, & National Grid Partners

Pico MES - An MES and factory operating system for mid-sized manufacturers

$12.4 million [Series A] - Led by Bosch Ventures and joined by Momenta, Counterpart Ventures, Congruent Ventures, Schneider Electric, Lemnos, and Union Labs.

ControlRooms.ai - An AI Troubleshooting and operations platform company for chemical and energy companies

$10 million [Series A] - Led by Origin Ventures and joined by Amity Ventures, Tokio Marine Future Fund, & S3 Ventures

Mujin - A company building intelligent motion planing platform for robotics in manufacturing, logistics, and supply chain operations

$85 million [Series C] - Led by SBI Investment and joined by Pegasus Tech Ventures & Accenture

Ascend Elements - A company that specializes in the manufacturing and recycling of advanced battery materials from spent lithium-ion batteries

$460 million [Series D] - Co-led by Decarbonization Partners, Temasek and Qatar Investment Authority

Weekly Planned Downtime

Coco Gauff Wins the US Open!