Breaking the Bottleneck | Issue 27

[10/10/2023] Supercapacitor News, Cadence's JediAI, DM Live Monitor & More

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, and a startup database. For an older version of a discrete and continuous manufacturing market map click the link here!

Content I Enjoyed This Week 🏭🗞️🔬

News:

MIT Engineers Create Supercapacitor out of Ancient Materials [SciTech Daily]

MIT engineers have developed a "supercapacitor" using historically abundant materials: cement, carbon black (similar to powdered charcoal), and water to provide a cost-effective ESS for renewable energy sources. The supercapacitor’s mixture results in a cement-based material with a high internal surface area due to a dense network of conductive material. Carbon black, introduced into the concrete mixture, forms a branching network of conductive structures inside the hardened cement. The new supercapacitor could help house foundations, retaining the structural strength while storing energy, and wirelessly recharging electric cars on the road. Because of supercapacitors’ ability to charge and discharge much faster, a 45 cubic meter block of this special concrete could store approximately 10 kilowatt-hours of energy, equivalent to a day's electricity usage for a household. For more information check out the paper in the journal PNAS by MIT professors Franz-Josef Ulm, Admir Masic, Yang-Shao Horn, and other collaborators from MIT and the Wyss Institute.

Pre Fab Parts & AI for Semiconductors [Fast Company]

Nanotronics, a NYC-based AI industrial firm, is proposing an innovative solution by building modular AI-driven chip factories that can be assembled like high-tech Lego blocks. The goal is to democratize the ownership of semiconductor fabrication plants, envisioning hundreds of their unique "flower-shaped" fabs worldwide. The factories can be pre-assembled, enabling easy transportation and setting up in diverse global locations, and can self-monitor and adjust operations. Furthermore, the approach can lead to quicker scalability than the traditional large-scale factories with each installation estimated to be under $100 million. To date, the company has raised $170 million from investors, including Peter Thiel and Jann Tallin, the Skype co-founder. They are in talks with potential partners in various industries and are targeting locations in the Middle East, Germany, Spain, and the U.S.

Desktop Metal Launches Live Monitor [DM]

Desktop Metal launched Live Monitor, a software application designed to deliver real-time data from printing systems. The tool aims to enhance the management and efficiency of either a single printing system or an entire fleet driving gains in OEE. Features include dashboards for managing a fleet, printer, or furnace performance metrics, maintenance management, job and event status, and time reporting. Aidro, an Italy-based firm specializing in hydraulic and fluid power systems manufacturing, has beta-tested Live Monitor and found it crucial for process control and part production traceability. Live Monitor will be available for users of various Desktop Metal printers and furnaces, with plans to extend its availability to other products in the future.

Cadence’s JedAI Generative AI Solution [Cadence]

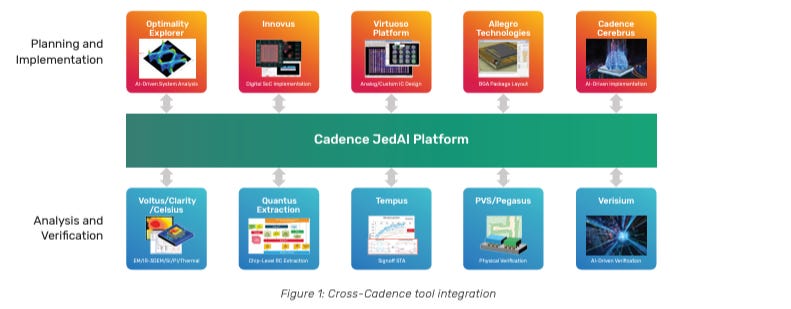

With the Cadence JedAI Platform, Cadence unifies its computational software innovations in data and AI across the Cadence Verisium™ AI-Driven Verification Platform, to the Cadence Cerebrus™ Intelligent Chip Explorer’s AI-driven implementation and the Cadence Optimality™ Intelligent System Explorer’s AI-driven system analysis. Together, these enable designers to use AI-driven optimization and debugging to create multiple designs in parallel with fewer engineers.

Rivian’s Quest to Build the Ultimate Truck [WSJ]

Rivian’s advanced and unique design comes at a high cost, with each truck selling for over $80,000 on average with the company losing around $33,000 on each vehicle sold in the second quarter. The company struggled with manufacturing and burned through half of its $18 billion cash reserve in two years with low production numbers and the factory operating at below a third of its capacity for its three models. Critics point to the vehicle's over-complicated design and decision to rely on in-house components as cost inflators. Analysts remain optimistic, stressing the quality and unique features of Rivian vehicles and the company is now working on renegotiating supplier contracts and cutting expenses to achieve profitability by the end of 2024.

The Search for Jet Engine Parts With Fake Safety Certificates [WSJ]

Major U.S. airlines are investigating the presence of fake-certified jet engine parts on their aircraft. These parts, which range from basic nuts and bolts to critical turbine blades, were incorporated into engines produced by a General Electric joint venture. The engines were then installed on widely used Boeing and Airbus planes. The counterfeit parts have been identified in 126 engines, leading airlines like American, United, Southwest, and Delta to ground affected planes for rectifications. At the heart of this controversy is AOG Technics, a supplier accused of falsifying documentation to sell these engine parts. The most affected engine is the CFM56, a popular model used in many of the aircraft currently flying. A significant safety risk arises due to the questionable components, especially as jet engines operate under high pressure and temperatures. While GE and Safran have prioritized safety and rectifications, the discovery of these counterfeit parts has raised concerns about the aerospace industry's verification systems and the global supply chain's vulnerabilities.

The Story Behind One iPhone Factory Powering Apple’s Pivot to India [Time]

A major Apple iPhone assembly hub exists outside of China in Sriperumbudur. The plant employs around 17,000 workers, who produce 6 million iPhones annually. This is part of Apple's broader shift to India. In 2022, the iPhone 14 began its assembly in India, and by 2025, it's estimated that 25% of all iPhones could be manufactured in India. Furthermore, plans are in place to expand the South Indian factory's production from 6 million to 20 million iPhones annually by 2024. However, there have been worker challenges that have come with the transition. In 2021, 159 workers were hospitalized due to food poisoning from a hostel, leading to significant media attention and protests regarding living and working conditions. Additionally, workers often face high production targets, with some handling up to 520 iPhones per hour. On top of that, there's a discrepancy in treatment between Foxconn's direct employees and those hired through third-party contractors, with the latter often getting fewer benefits and job security. Finally even with Apple's roughly 35% profit margin factory workers earn a wage that would require them to save for approximately six months (without any expenses) to buy a single iPhone.

Research:

Training Tomorrows Advanced Manufacturing Employees Today [Buckeye Institute]

Podcasts:

Common Gaps Being Ready for Manufacturing [Product Startup]

US Semiconductor Controls are Failing [Hidden Forces]

Chart of the Week:

Germany (lhs) and France (rhs). Germany is having a manufacturing recession that's worse than the 2020 COVID-19 shock. France has a services recession that's as bad as during the peak of the Eurozone debt crisis in 2012. This is all while Russia is experiencing a manufacturing revolution

Track the Clean Manufacturing Factories Being Built Across the US

Manufacturing Deals

KittyCAD - A company building the modern infrastructure for hardware design including a modeling app and design diff viewer

$5 million [Seed] - Led by Venrex Partners and joined by Gaingels, Liquid2, and other strategic angel investors

Machina Labs - A company building an agile manufacturing platform integrating 7-axis robots, autonomous sheet loading and fixturing, and advanced AI process models and closed-loop controls.

$32 million [Series B] - Co-Led by Nvidia’s NVentures and Innovation Endeavors

Castelion - A company rethinking defense hardware development for complex systems, starting with long-range strike hypersonic weapons.

$14.2 million [Seed] - Co-Led by Andreessen Horowitz and Lavrock Ventures and joined by First In, BlueYard Capital, and Champion Hill Ventures

MuirAI - A company that generates actionable data to report supply chain emissions and identify reduction opportunities

$3.25 million [Seed] - Led by Base10 Partners and joined by Madrona Venture Labs and Soma Capital

Mach Industries - A defense tech startup delivering decentralized warfare capabilities

$79 million [Series A] - Led by Bedrock Capital

Weekly Planned Downtime

Go Jackets!!