Breaking the Bottleneck | Issue 50

[6/3/2024] Solar Manufacturing, Tariffs, Gen AI Design, & Fictiv's 2024 State of Manufacturing Report!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

🗺️ Check out these market maps for new discrete/process manufacturing tech!

💥 Have you seen any exciting startups recently? I’d love to chat with them!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🏭🗞️🔬 📚

News:

The Solar Breakthrough That Could Help the U.S. Compete With China [WSJ]

An Israeli startup, Lumet, has developed a new technology set to revolutionize solar panel manufacturing. Founded by Benny Landa, Lumet aims to simplify the metallization step in solar panel production, cutting down the amount of silver required to capture sunlight. South Korea's Hanwha Group, through its Qcells unit, plans to be the first to adopt Lumet's technology, contributing to its multibillion-dollar solar supply chain in Georgia. Lumet's technology offers thinner and more efficient silver fingers, crucial for cost reduction as silver prices surge. The process involves coating plastic films with silver paste, which is then transferred to solar cells, eliminating the need for bulky equipment and streamlining production. While Qcells has been testing Lumet's technology for nine months, specifics regarding deployment timelines and cost reductions remain undisclosed. Nevertheless, Qcells' Georgia supply-chain project is progressing, with module assembly already underway and further production stages expected to commence soon.

Watch This Space Here Come Generative Manufacturing Designs [Engineering]

Infinitform aims to create generative software capable of designing usable and manufacturable parts. Unlike traditional generative design software, InfinitForm focuses on optimizing parts with cutting tools in mind, a departure from the roundabout methods used by existing software. InfinitForm allows users to specify the number of axes and size of cutting tools, offering a tradeoff between production time and level of detail. Notably, the software outputs solid models, distinguishing it from other shape optimizers that produce triangulated meshes. Michael's decision to prioritize machinable parts reflects a shift from the previous emphasis on 3D printing. Despite the hype around lightweight parts produced by generative design, Michael recognizes the importance of manufacturability and cost-effectiveness. The optimization process, powered by advances in hardware like GPUs, can now happen rapidly, with complex models solved in seconds. InfinitForm plans to release its software initially as a cloud-based solution, with a local option to follow. This local solution will cater to industries like military and defense, which require security measures that preclude cloud usage.

Will Tariffs on EVs, Solar, and Other Cleantech Help Americans? [Canary Media]

In May, the Biden administration made a series of trade rulings aimed at boosting American manufacturing. These rulings include increasing tariffs on $18 billion worth of annual imports from China, focusing on electric vehicles (EVs), solar panels, and critical materials such as uranium. Biden's latest trade actions against China include accusations of unfair trade practices, technology transfer, and dumping of low-priced exports, echoing complaints from the European Union, India, and other nations. In the EV sector, Biden is increasing tariffs on Chinese imports, despite their current minimal presence in the U.S. market. However, even a 100% tariff may not deter consumers, given the pricing advantages of Chinese EVs over Western counterparts. In the solar industry, China's dominance presents a different challenge, with Biden confronting trade imbalances through tariffs to protect American producers from below-market-priced imports. Tariff rates on Chinese solar cells are set to increase, and investigations into anti-dumping claims further highlight the complexity of trade disputes. Despite the administration's efforts, not all U.S.-based solar manufacturers support these tariffs, arguing that they stifle innovation and competition. Additionally, tariffs on Chinese lithium-ion batteries and critical minerals are being raised, further complicating trade relations. While tariffs may offer political advantages, their societal benefits remain uncertain. Think tanks across the political spectrum highlight potential drawbacks, including increased costs for consumers and reduced trade. Furthermore, tariffs have not catalyzed a viable domestic manufacturing sector in solar, with the U.S. still heavily reliant on imports.

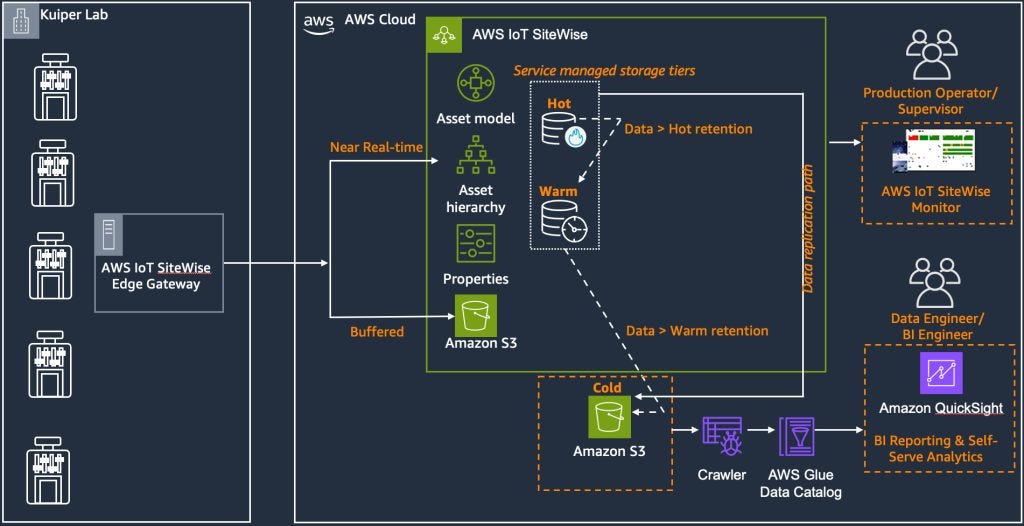

Optimizing Project Kuiper’s Satellite Manufacturing Efficiency [AWS]

Project Kuiper, Amazon's ambitious project to provide broadband internet via a low Earth orbit (LEO) satellite network, relies on cutting-edge manufacturing processes to produce high-precision components for its satellites. Leveraging CNC machining, the Project Kuiper team assembles thousands of satellites with the aim of delivering fast, affordable connectivity to underserved communities worldwide. Project Kuiper needed a solution for near real-time (NRT) monitoring and equipment analysis to optimize their complex manufacturing operations. They turned to AWS IoT SiteWise, a managed service designed to collect, store, organize, and monitor industrial equipment data at scale. AWS IoT SiteWise Edge software collected manufacturing data from CNC machines and forwarded it to AWS IoT SiteWise in the cloud. AWS IoT SiteWise then organized manufacturing assets into a hierarchical structure, facilitating contextualized data analysis for stakeholders. Multi-tiered storage optimized cost and performance, retaining frequently accessed data in hot storage for real-time monitoring while automatically moving older data to cost-effective tiers for long-term analysis. Data visualization played a crucial role in monitoring operational efficiency, with AWS IoT SiteWise Monitor providing NRT operational dashboards. These dashboards tracked key metrics such as overall equipment effectiveness (OEE), defect rates, cycle times, and throughput efficiency. For longer-term analysis, Project Kuiper utilized Amazon QuickSight, enabling in-depth data inspections over extended historical timeframes. Since deploying the above architecture, Project Kuiper has seen improved OEE, reduced unplanned downtime, and enhanced asset utilization.

The Economics of Additive Manufacturing are Broken [TCT Opinion]

The Op-Ed discusses the challenges facing industrial 3D printing (additive manufacturing or AM) and proposes solutions to unlock its potential for widespread adoption. Currently, industrial 3D printing remains limited to boutique manufacturing and prototyping, lacking urgency due to the minimal incentive to invest in it and the complexity of designing for AM. Two main challenges hinder its advancement: the lack of understanding among engineers on how to design for AM and the prohibitive production costs despite designing for it. Despite the inherent flexibility of AM, it is currently one of the most expensive manufacturing processes due to high production costs and expensive consumables, which perpetuates a self-perpetuating cycle of high costs and limited market adoption. To address these challenges, industrial 3D printer companies should invest in automating their manufacturing processes to reduce costs and increase production efficiency, and AM should be integrated into more industrial workflows to drive down costs and enable broader adoption. Service providers could adopt pricing models based on machine utilization to make AM more economically viable for end-use parts. China's example of offering lower costs and more competitive pricing with industrial 3D printers drives faster adoption within China, highlighting the need for strategic investments in AM infrastructure and automation to unlock its potential for widespread impact on global manufacturing.

Research:

Fictiv 2024 State of Manufacturing Report

Fictiv released its State of Manufacturing Report tracking perspectives on the economy, supply chain, AI, sustainability, and more. Here are some of the highlights:

AI and Hiring - 87% of respondents agree that implementing AI into manufacturing is "...vital to my company's future success." Notably, nearly half of companies say that AI has enabled them to reduce planned hiring, and 34% expect AI to impact hiring in the next two years.

New Product Innovation - The focus on increasing the speed of innovation (45%) remains high, and reports of barriers to innovation have decreased across the board. In fact, the number of respondents reporting no barriers (15%) more than doubled since last year to its highest level in four years.

Global Supply Chain - 86% of respondents say global tensions are long-term planning considerations. However, while it is still important for U.S. manufacturers to go onshore (66%), this trend has fallen since last year (77%), even as diversifying global manufacturing operations has increased this year.

Supply Chain Regionalization - Increasing U.S. manufacturing (on-shoring) remains the leading supply chain strategy for the third year (66%), yet it has fallen substantially since last year. At the same time, North American production (near-shoring) has increased again this year (53%).

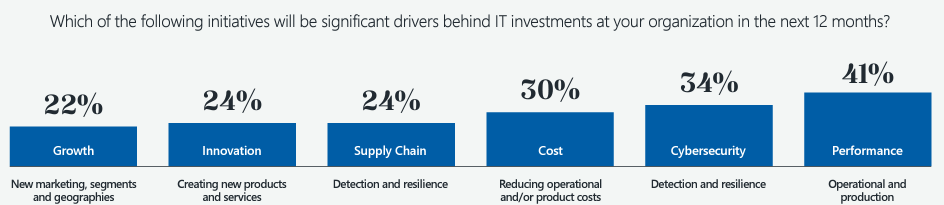

Rootstock 2024 State of Manufacturing Technology Survey

Rootstock released its State of Manufacturing Technology survey assessing how manufacturers view their digital transformation journeys. Here are some of the highlights:

Despite 90% of manufacturers utilizing some form of AI in their operations, the survey revealed there is a level of imposter syndrome when it comes to AI implementation and progress, with 38% reporting they feel behind their peers

Manufacturers show a positive outlook on digital transformation (63%), with the majority feeling they’re at least on par with peers (39%) or slightly ahead (24%).

Manufacturers anticipate significant negative impacts from current economic conditions. The top concerns were unreliable suppliers (39%) and decreased demand (36%).

Over half (51%) of manufacturers are planning to increase spending in this area (such as ERP, CRM, HCM, SCM, and finance), underscoring the importance of these digital tools for future growth.

Manufacturers leveraging Cloud ERP reported reduced overall costs (56%), improved IT security (46%), and enhanced business agility and resiliency (46%).

Podcasts/Video:

Workers Wanted: How to Fill The Skilled-Trade Shortage [McKinsey]

Manufacturing Deals🏭💵

Reibus - A company building an independent marketplace for metals procurement

$30 million [Equity & Debt] - From Canaan Partners, Nosara, and HSBC

EthonAI- A company building AI models tp drive operational excellence across manufacturing

$16.5 million [Series A] - Led by Index Ventures and joined by General Catalyst, Earlybird, and Founderful

Infinitform - A company building the AI copilot for manufacturing design

$2.25 million [Seed] - Led by Schematic Ventures

Planned Downtime 🏭🧑🔧

Lewis Hamilton on Hot Ones