Breaking the Bottleneck | Issue 57

[9/8/2024] IMTS Links, Green Steel, 3D Printing in Space, & More

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

💥 If you are building, operating, or investing in manufacturing, hardware, or robots, please reach out. My email is aditya@schematicventures.com – I’d love to connect!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🏭🗞️🔬 📚

IMTS 2024 kicks off in Chicago with many new products and technology to be revealed! Here are some quick links and info on the conference:

North Building Level 3 - Abrasive Machining, Automation, Machine Components/Cleaning/Environment

East Building Level 3 - Software, Additive, Quality Assurance, Components

South Building Level 3 - CNC, Metal Removal

West Building, Level 3 - Additive, Tooling & Workholding

IMTS Additive Manufacturing Preview

News:

TSMC’s Arizona Trials Put Plant Productivity on Par with Taiwan [Bloomberg]

Taiwan Semiconductor Manufacturing Co. (TSMC) has achieved production yields at its new Arizona facility comparable to its well-established plants in Taiwan, signaling that its U.S. expansion is on track. The chipmaker’s trial production, which uses advanced 4-nanometer process technology, has yield rates similar to those of its Tainan facilities in Taiwan. This is significant as yield rates—indicating the number of usable chips produced in a manufacturing process—are crucial for profitability. Although TSMC does not publicly disclose its yield rate, maintaining high yields is critical to achieving its goal of sustaining gross margins of 53% or higher, with the company’s net profit consistently above 36% over the past four years. TSMC initially aimed to start total production at its Arizona plant in 2024 but delayed this to 2025 due to a shortage of skilled workers, raising concerns about the efficiency of the U.S.-based output. Despite the delay, TSMC maintains that the project is progressing well. The U.S. government supports TSMC’s $65 billion investment in three Arizona plants with $6.6 billion in grants and up to $5 billion in loans.

Greener Steel Production Requires More Electrochemical Engineers [IEEE]

The Hall-Héroult smelting process, developed in 1886, revolutionized aluminum production by enabling the electrochemical reduction of aluminum oxide and dramatically reducing costs. However, traditional steelmaking methods rely on burning fossil fuels at over 1,600°C, accounting for about 10% of global CO2 emissions. Electrochemistry, which allows for the direct electrical control of oxidation-reduction reactions, is emerging as a solution. Scientists are applying electrochemical techniques to convert ore into iron, the most polluting step in steel production. This transition can significantly reduce emissions by optimizing processes for mass efficiency rather than energy efficiency, especially as renewable electricity becomes more affordable. With advancements in photovoltaic panels, wind turbines, and electrical distribution systems designed for electric vehicles, electrochemical reactors can become modular and efficient, allowing for large-scale, sustainable production. The growing importance of electrochemistry is reflected in academia, where previously elective courses in electrochemical engineering are now integral to top research institutions. However, scaling electrochemical production will require a concerted effort by the next generation of engineers.

North American Robot Sales Decline 8% in H1 2024 [Robot Report]

According to the Association for Advancing Automation (A3), in the second quarter of 2024, North American robot sales dropped by 9.7% compared to Q2 2023, with 7,123 robots ordered. Despite this decline in units, the total sales value rose 6.9% to $489 million, reflecting a shift toward higher-value, advanced robots. A3 attributed this to the growing demand for sophisticated automation to combat labor shortages and enhance production efficiency amid economic uncertainties. A3 also reported a 6% drop in robot sales in Q1 2024 compared to the same period in 2023, with 8,582 robots sold for $494 million. This follows a 30% decline in 2023, after record sales in 2021 and 2022 during the height of the COVID-19 pandemic. The decrease in robot sales is primarily driven by a slowdown in traditionally strong sectors like automotive components and semiconductors, which saw drops of 39% and 40%, respectively. However, other industries continued to invest in robotics, with the food and consumer goods sector growing by 86% and life sciences and pharmaceuticals increasing by 48%. Specific robotics applications showed mixed results: handling operations saw a 4% increase in orders but a 2% decline in shipments, while welding and soldering experienced sharp declines, with orders dropping by 31%. A3 remains cautiously optimistic for the second half of 2024 despite ongoing headwinds. The global robotics market, particularly in China, is advancing rapidly, with China positioning robotics as a key driver of economic growth. This further highlights the challenges North American robotics faces in comparison.

The Gigacasting Question [Forbes]

Gigacasting, also known as megacasting or hypercasting, is revolutionizing automotive manufacturing by enabling the production of large, complex metal parts through high-pressure die-casting techniques. EV battery E.V.cks, which weigh significantly more than traditional internal combustion engine components, have intensified the need for lightweight, high-strength castings to enhance vehicle performance and efficiency. Tesla has been at the forefront of gigacasting, achieving a 40% cost reduction for the rear of its Model Y through this technique by simplifying assembly processes. Gigacasting also offers substantial production time savings, with fewer parts and reduced labor costs. Although the materials used in gigacasting, such as aluminum alloys, are more expensive, the overall cost benefits and flexibility of changing mold designs outweigh these concerns. Tesla’s success inspires other automakers, such as Toyota, Hyundai, Volkswagen, and Mercedes-Benz, to adopt gigacasting by 2026. Successful gigacasting requires advanced systems for molten metal injection, sophisticated mold designs, vacuum assistance to reduce porosity, and rigorous quality control measures like CT scanningC.T.nd machine learning. Engineering challenges include ensuring consistent wall thickness, overcoming high upfront costs, addressing limited production flexibility, and managing potential repairability concerns due to the integrated nature of parts. As manufacturers explore the pros and cons, innovations like NIO’s heat-treatment-free materials could further improve the efficiency of gigacasting. Despite challenges, gigacasting has the potential to reshape the future of automotive production, particularly in the EV market, E.V. it offers an efficient, cost-effective solution for producing large, high-strength components.

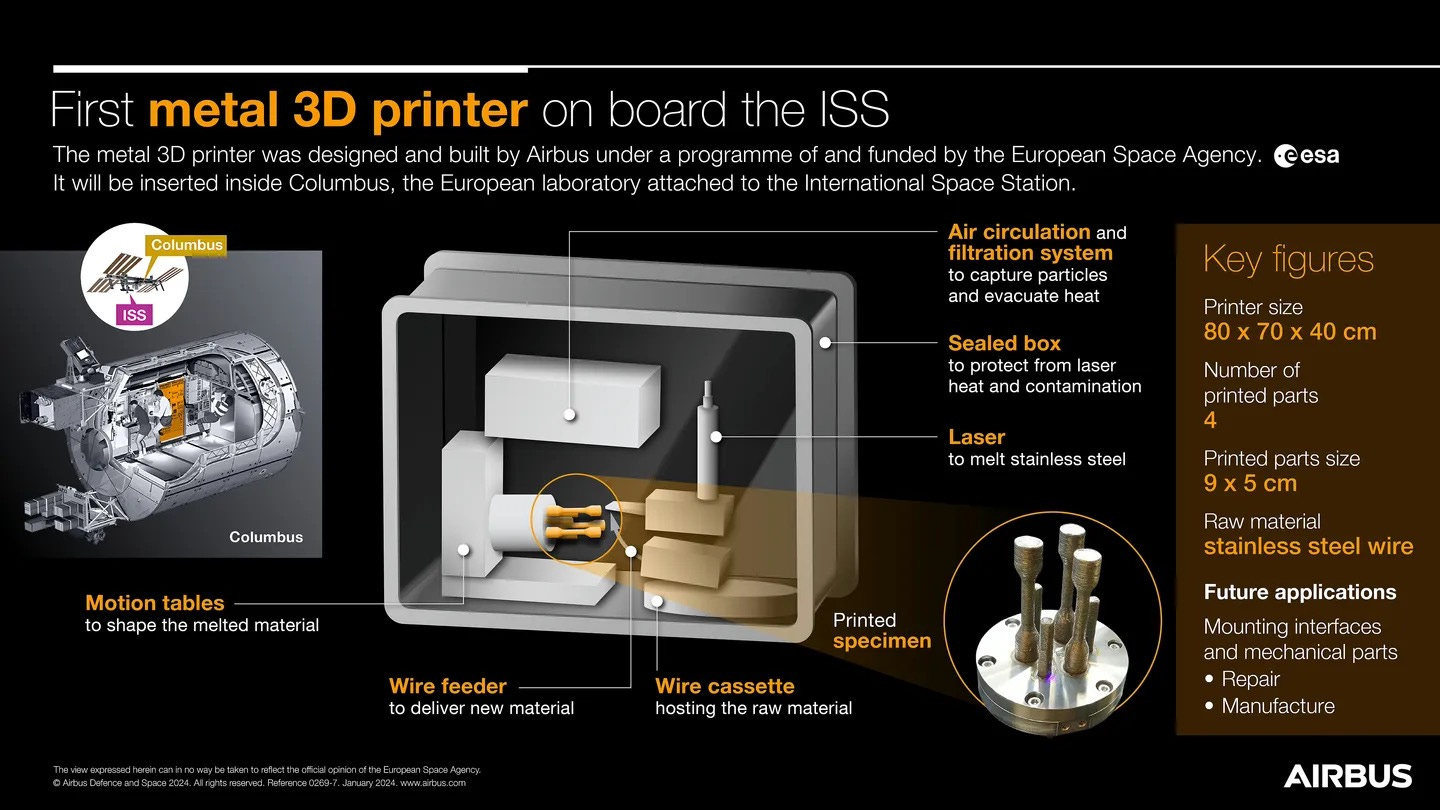

Behind The Scenes Of The First Metal Part 3D Printed On The ISS [VM]

In August 2024, a significant milestone in space manufacturing was achieved when the first-ever metal part was successfully 3D printed aboard the International Space Station (ISS). This breakthrough, led by the European Space Agency (ESA) and developed by Airbus and partners, produced metallic components in microgravity. This advancement opens new doors for space exploration, allowing astronauts to create essential tools and parts directly in orbit. The capability could also reduce the need for costly resupply missions and enhance the self-sufficiency of long-duration space missions, such as those to Mars. Overcoming the challenges of manufacturing in microgravity, including material deposition and maintaining structural integrity, required innovative technologies. The successful printing of the part involved real-time monitoring and adjustments to ensure precision. Future phases of the project will compare the mechanical properties of the part produced in space with those made on Earth, providing insights for refining in-space manufacturing.

Research:

The Shifting Dynamics of Nearshoring in Mexico [BCG]

In 2023, Mexico overtook China as the US’s top trade partner, reinforcing its position as a key production hub and export market for the US. This shift is mainly due to low labor costs, geographic proximity, and preferential market access through the US-Mexico-Canada Agreement (USMCA), the successor to NAFTA. Mexico’s exports to the US hit a reU.S.rd $475 billion in 2023, with FDI in manufacturing rising 20% annually since 2019, compared to a global increase of 7%. Electric vehicles (EVs) are a growth area, with companies like BMW, Volkswagen, Tesla, and Chinese firms such as BYD and Jetour announcing or planning significant investments. Mexico’s extensive network of component suppliers and well-established industrial clusters supports its manufacturing momentum. However, Mexico faces growing challenges that could undermine its competitiveness. Labor costs have surged, with factory wages rising by an annual average of 20% since 2019. Skilled labor shortages are intensifying, especially in the north, with unemployment at just 2.7% in late 2023. These shortages affect 25% of Mexican firms, driving high attrition rates of up to 60% at some factories. Meanwhile, infrastructure is strained, with electricity costs double those in the US and China, and water scarcity is a pressing concern, particularly in northern industrial states. As a result, some companies are exploring alternatives in Central America and the Caribbean. For example, Costa Rica and the Dominican Republic offer competitive labor costs and established supplier networks in industries like medical devices, though they lack Mexico’s logistical proximity to the US. UltimatU.Sy, Mexico remains the leading nearshoring option for industries requiring low costs and fast time to market, but evolving trade policies and rising costs are prompting a reevaluation of its competitive edge.

Podcasts/Video:

How the US GovernmeU.S. is Innovating in Its Efforts to Fund Semiconductor Manufacturing [HBR]

Xometry’s Vision for AI-Driven AM [VoxelMatters]

Manufacturing Deals🏭💵

Entalpic - A French materials discovery startup factoring in physicochemical and manufacturing constraints.

€8.5 million [Seed] - Co-led by Breega, Cathay Innovation, and Felicis.