Breaking the Bottleneck | Issue 60

[9/29/2024] ReMEmbR, 2024 Industrial Robotics Report, & Manufacturing Policy Perspectives!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

💥 If you are building, operating, or investing in manufacturing, hardware, or robots, please reach out. My email is aditya@schematicventures.com – I’d love to connect!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🏭🗞️🔬 📚

News:

TSMC’s AI Chip Capacity Growth Ahead Of Schedule [WCCFTech]

Morgan Stanley forecasts that Taiwan Semiconductor Manufacturing Company (TSMC) will expand its Chip-on-Wafer-on-Substrate (CoWoS) chip packaging capacity to 80,000 monthly wafers by 2025. This advancement is propelled by surging AI demand. The bank's optimism is also reflected in raising TSMC's share price target from NT$1,220 to NT$1,280. According to Morgan Stanley analyst Zhan Jiahong, TSMC's recent acquisition of an NT$17 billion factory in Taiwan in August has facilitated this expedited timeline. Additionally, the analyst is bullish on TSMC's leading-edge 3-nanometer (3nm) chip manufacturing process. He projects that TSMC's 3nm capacity will grow from 90,000 wafers per month in 2024 to 120,000 wafers per month in 2025, driven by demand from the AI industry and potential orders from companies like Intel and Apple. While Intel's shift of some chip manufacturing to TSMC is factored into the model, the bank notes that this has not been confirmed. TSMC's 2nm production is also expected to scale from 10,000 wafers per month in 2024 to 50,000 wafers per month in 2025, reaching 80,000 wafers per month in 2026 as the 2026 iPhone ramps up production. By 2026, the 3nm capacity will reach 140,000 wafers per month, including 20,000 wafers from TSMC's U.S. facilities.

Car Software Patches are Over 20% of Recalls [Ars Technica]

According to an analysis by DeMayo Law of a decade's worth of National Highway Traffic Safety Administration (NHTSA) recall data, software fixes now account for more than 1 in 5 automotive recalls. In 2014, software-related recalls constituted approximately 12% of all automotive recalls, with 34 out of 277 being software fixes. This percentage remained around 12–13% until 2020, after which it began to rise steadily. In 2021, software fixes accounted for 16% of recalls (61 out of 380), increasing to nearly 22% in 2022 (76 out of 348) and topping 23% last year with 82 out of 356 recalls involving software remedies. Leading the trend is Chrysler, with 82 software recalls since 2014, followed by Ford with 66 and Mercedes-Benz with 60. Tesla, often considered a software-centric automaker, ranks eighth with 26 software recalls, comparable to Hyundai (25) and Kia (25). The most common issues requiring software fixes pertain to electrical systems, backover prevention features like reversing cameras and collision warnings, airbags, powertrains, and exterior lighting. Notably, some recalls involve software updates to address hardware problems; for example, Jaguar issued a software update to its I-Pace vehicles to limit battery charging capacity after battery fires caused by damaged cells. While over-the-air (OTA) updates allow newer vehicles to receive software patches without visiting a dealership, this process isn't always seamless. Some Rivian owners experienced issues when an update disrupted their infotainment screens. As vehicles become increasingly software-defined, with powerful computers replacing numerous single-function components, the reliance on software fixes is expected to escalate.

ReMEmbR Shows How Generative AI Can Help Robots Reason [Robot Report]

How Foreign Investment Is Boosting U.S. Manufacturing [HBR]

In August 2022, the United States enacted the CHIPS and Science Act and the Inflation Reduction Act, committing hundreds of billions of dollars to revitalize domestic manufacturing, particularly in sectors like semiconductors, batteries, and electric vehicles. This investment has led to a surge in U.S. manufacturing construction in 2024, more than three times the level in 2019. A significant but often overlooked driver of this growth is foreign direct investment (FDI). Over 40% of the largest manufacturing "megadeals" (factories requiring over $1 billion in investment) since 2021 are FDI projects. For instance, two of the four largest semiconductor manufacturing investments since 2020 were made by foreign companies. South Korean firms Hyundai and LG are each investing more than $5 billion to build battery supply chains in the U.S. Even American companies like Ford partner with foreign firms such as South Korea-based SK On in joint ventures worth billions. Research indicates that foreign-owned factories are often more productive, higher-paying, and technologically advanced than their domestic counterparts because they are typically industry leaders capable of investing abroad. Every job created by FDI in manufacturing is associated with an additional $13,400 in wages and $135,000 in additional revenues for regional workers and firms. These benefits, however, are not guaranteed and depend on foreign firms investing in local ecosystems and sharing knowledge. Successful examples like BMW's investment in South Carolina show how investing in regional workforce development can transform local industries, turning South Carolina into an automotive powerhouse with productivity almost double the national average. Conversely, failures like Volkswagen's 1970s investment in Pennsylvania highlight that benefits are not automatic. The new wave of manufacturing projects, including those in Columbus, Ohio, and Phoenix, Arizona, can learn from these lessons by investing in regional talent development and fostering openness to share knowledge, ensuring long-term success that benefits foreign investors and domestic industries.

The Biden Manufacturing Boom That Isn’t [WSJ Opinion]

Despite significant government investment, U.S. manufacturing output has not fully recovered from its pandemic plunge and is lower than in 2013. Most of the manufacturing growth under President Biden occurred during his first year in office amid the post-COVID rebound, fueled by increased demand for goods super-charged by pandemic-related spending. While spending on the construction of new factories has more than doubled during the Biden years, automakers are scaling back electric vehicle production, potentially leading to under-utilized factories. Furthermore, the Institute for Supply Management’s Purchasing Managers Index indicates that the manufacturing industry has been in almost continuous contraction since the autumn of 2022, shortly after President Biden signed the IRA and CHIPS Act. Investment in new industrial equipment has been notably weaker under Mr. Biden than under Donald Trump, suggesting fewer manufacturers are refurbishing existing plants and investing in technology to enhance global competitiveness. Regarding jobs, employment has increased in businesses boosted by subsidies, such as semiconductors (17,800 jobs) and batteries (8,800 jobs). Still, jobs have declined in sectors affected by regulation and inflation, including oil and gas machinery (-10,400 jobs), foundries (-7,200 jobs), and fabricated metals (-6,800 jobs). Real average weekly wages for manufacturing workers are 2.7% lower than in January 2021. Finally, the Environmental Protection Agency (EPA) has imposed rules requiring steel mills and iron foundries to limit carbon emissions. U.S. Steel cautioned it might close its Mon Valley plant if the government blocks its acquisition by Nippon Steel. Additionally, despite minimal connections, the EPA has imposed stringent emissions limits on paper, cement, glass, steel, iron, and chemical manufacturers to reduce smog in downstream states. The uncertainty caused by these myriad rules has chilled investment, with electric transformer manufacturers last year warning that proposed efficiency standards made it difficult to scale up production, impacting other business investments, including housing projects and data centers.

Research:

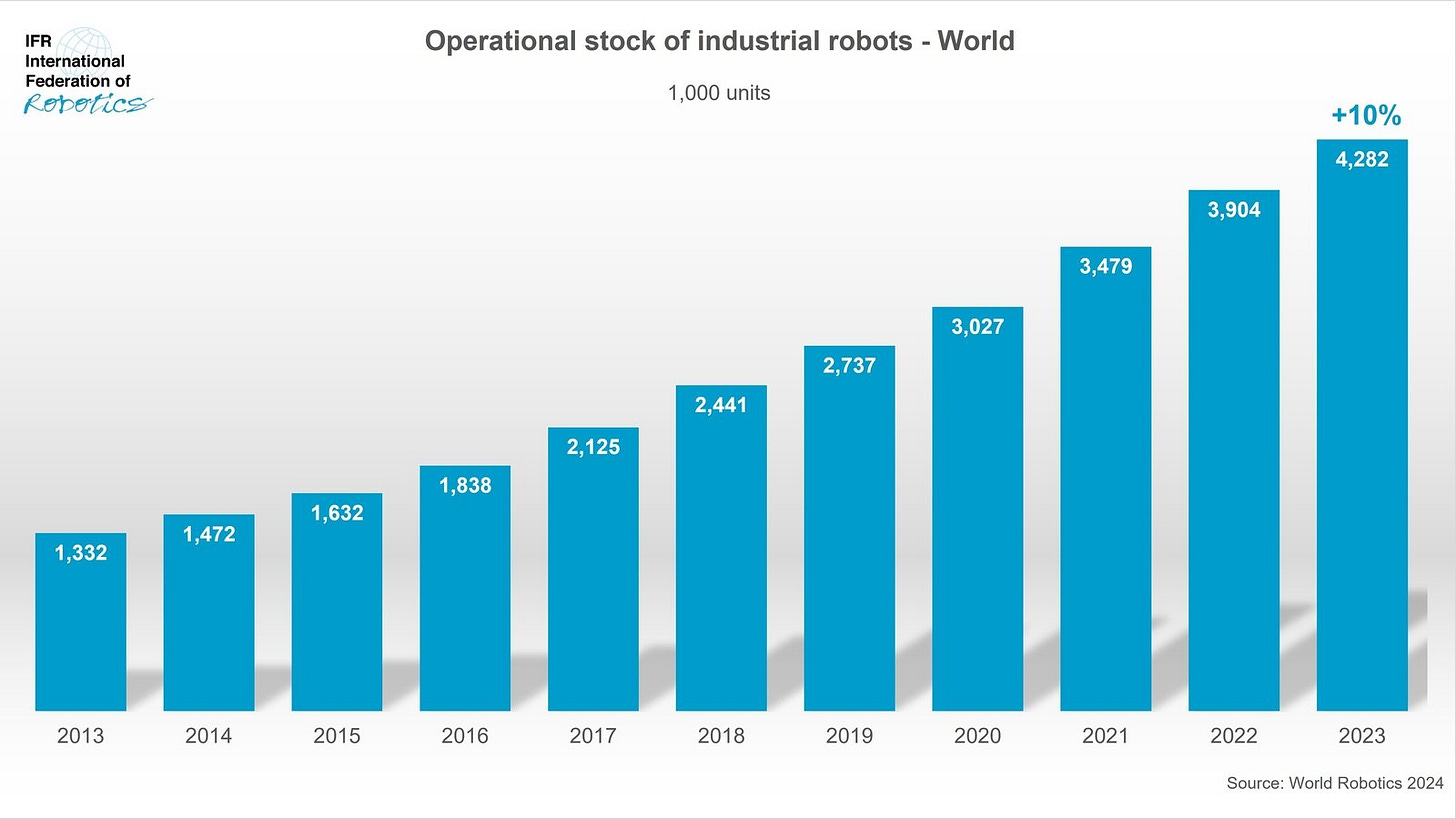

2024 International Federation of Robotics Report [IFR]

According to the 2024 World Robotics report, the number of operational industrial robots worldwide has reached a record high of 4,281,585 units, marking a 10% increase from the previous year. Annual installations exceeded half a million units for the third consecutive year, with 541,302 units installed in 2023, making it the second-highest year in history—only 2% lower than the peak in 2022. By region, 70% of all newly deployed robots in 2023 were installed in Asia, 17% in Europe, and 10% in the Americas. China solidified its position as the world's largest market, installing 276,288 industrial robots in 2023, representing 51% of global installations. This is China's second-highest level ever recorded (2022 saw 290,144 units). The share of Chinese manufacturers in the domestic market surged to 47% in 2023 from an average of 28% over the past decade. China's operational stock neared 1.8 million units, making it the first and only country with such a vast robot population. Europe saw industrial robot installations rise by 9% to a new high of 92,393 units, driven by solid investment in the automotive industry across countries like Spain (+31%), Slovakia (+48%), and Hungary (+31%). In the Americas, installations remained robust, with 55,389 units in 2023, just 1% below the record set in 2022, with the United States accounting for 68% of the regional total despite a 5% decrease to 37,587 units.

MLOps: A Multiple Case Study in Industry 4.0 [Leonhard Faubel, Klaus Schmid]

Abstract: As Machine Learning (ML) becomes more prevalent in Industry 4.0, a growing need exists to understand how systematic approaches to bringing ML into production can be practically implemented in industrial environments. Here, MLOps comes into play. MLOps refers to the processes, tools, and organizational structures used to develop, test, deploy, and manage ML models reliably and efficiently. However, there is currently a lack of information on the practical implementation of MLOps in industrial enterprises. To address this issue, we conducted multiple case studies on MLOps in three large companies with dedicated MLOps teams. We used established tools and well-defined model deployment processes in the Industry 4.0 environment. This study describes four companies' Industry 4.0 scenarios and provides relevant insights into their implementation and the challenges they faced in numerous projects. Further, we discuss MLOps processes, procedures, technologies, and contextual variations among companies.

Higher Labor Intensity in Automotive Plants After Transitioning To EVs [Nature]

Abstract: It has been widely suggested that the transition to battery electric vehicles will require 30% fewer assembly workers than those needed for internal combustion engine vehicles. We use publicly available vehicle production and employment datasets to show that labor intensity has increased at U.S. vehicle assembly plants that have fully transitioned to assembling battery electric vehicles. During the production ramp-up period, labor intensity increases by more than ten-fold compared to historic combustion vehicle assembly labor intensity. For one assembly site studied, labor intensity and total employment remained three times higher after a decade of electric vehicle production. Our study suggests that electric vehicle assembly sites may take over 15 years to achieve labor intensity parity with internal combustion vehicle assembly. Thus, rapid, widespread loss of employment at vehicle assembly plants is a more negligible risk than many fear. Moreover, our study calls for more regionally focused analyses of the transition’s effects on labor using data-driven and macro-level surveying approaches.

Podcasts:

Manufacturing Deals🏭💵

Vsim - A British simulation startup using Finite-Difference Time-Domain (FDTD), Particle-in-Cell (PIC), and Charged Fluid (Finite Volume) methods

$28 million [Series B] - Led by Mayfield and joined by General Catalyst and Abstract Ventures

Cybord - An Israel startup providing inline visual-AI platform performs authentication, analytics, and traceability for electronic components

$8.7 million [Series A] - Led by Capri Ventures and joined by Ocean Azul Partners, IL Ventures, and NextLeap Ventures

Toolpath Labs - A startup providing a AI-powered CAM automation for Machine Shops

$10 million [Seed] - Led by Leaders Fund and joined by Tech Square Ventures, BLH Venture Partners, Carl Bass, John Saunders, and Christian Welch

Downtime 🏭🧑🔧

Roger Federer & Trevor Noah