Breaking the Bottleneck | Issue 67

[12/9/2024] IBM's Automated Fab, New Design Data Set, New Public Market Comps + Tractian!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

💥 If you are building, operating, or investing in manufacturing, hardware, or robots, please reach out. My email is aditya@schematicventures.com – I’d love to connect!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🏭🗞️🔬 📚

News:

Forgotten Story About How IBM Invented The Automated Fab [IEEE Spectrum]

In the early 1970s, IBM launched a groundbreaking effort called Project SWIFT under the leadership of William E. Harding at its East Fishkill, N.Y., facility. The goal was extraordinarily ambitious: to build a fully automated integrated-circuit (IC) manufacturing line capable of producing complex chips in under one day. Project SWIFT began in 1970 when conventional IC fabrication took more than a month per batch. IBM’s standard RAM II memory chips required dozens of manual steps, and each wafer spent most of its time waiting between processes. SWIFT’s target was a one-day turnaround—from bare silicon wafers to finished, testable integrated circuits. By comparison, regular production lines took about 30 days. SWIFT aimed to compress that into roughly 20 hours, with “raw process time” (actual processing) under 15 hours. SWIFT averaged just 5 hours of fabrication time per process layer. Despite today’s vastly more sophisticated technology, advanced fabs take about 19 hours per layer at best, with an industry average closer to 36 hours per layer. Even accounting for differences in complexity and wafer size, SWIFT’s speed has never been equaled.

This was a result of a few process and equipment innovations. Instead of batch processing, SWIFT handled individual wafers continuously through automated operations. Five enclosed “sectors” contained all the steps needed between lithographic pattern exposures. Each sector performed multiple chemical, thermal, and lithographic prep processes sequentially, and wafers were moved between stations using a single wafer transport system. SWIFT employed a three-level control hierarchy. An IBM 1800 computer tracked each wafer (each assigned a unique serial number), managed the line’s logistics, recorded processing parameters, and ensured out-of-spec conditions were detected immediately. Dedicated controllers managed each sector’s internal operations, and individual processing modules had their specialized controls. Finally, they used innovative wafer-handling techniques, including supporting wafers with airflows rather than gripping them. Some equipment, such as air-track wafer transports, was integrated despite contamination concerns to maintain internal support from other IBM sites. The results were incredible. The pilot facility, during its five extended runs between mid-1974 and early 1975, SWIFT processed about 58 wafers per day (83% of its 70-wafer target), achieving a full wafer turnaround time of about 20 hours. The finished RAM II circuits' yield equaled the conventional line's best yield.SWIFT pioneered features now standard in modern fabs—computerized process control, single-wafer handling, localized clean environments, rapid lithography methods, real-time data tracking, and shorter processing steps integrated end-to-ends and influenced all future semiconductor manufacturing strategies.

He Was Going to Save Intel. He Destroyed $150 Billion of Value Instead [WSJ]

Under Pat Gelsinger's leadership, Intel attempted one of modern history's most ambitious corporate turnarounds. Gelsinger, who started as a technician at Intel in 1979 and became its first CTO by 2000, returned as CEO in 2021 when the chip industry’s geopolitical and economic importance was unprecedented. His “IDM 2.0” strategy sought to challenge industry norms by combining design and manufacturing, unlike competitors such as Nvidia and TSMC. He aimed to revive Intel’s manufacturing edge by building new, multi-billion-dollar fabs. Gelsinger set an aggressive pace, promising five major chip-manufacturing advances within four years and championing the 2022 CHIPS Act to secure government funding. Despite early board backing, Intel’s turnaround struggled. By late 2023 and into 2024, Intel’s market value had plummeted more than 60%, losing about $150 billion, while Nvidia’s surged by $3 trillion. Once similarly valued, Intel now ranks below companies like Boeing and Starbucks. In October 2024, Intel reported a historic net loss of $16.6 billion in a quarter, far exceeding analyst projections. Furthermore, efforts to diversify through mergers, including a $30 billion bid for GlobalFoundries, faltered. Although Intel invested heavily in U.S. manufacturing and aligned closely with government priorities, customers and investors turned to more agile competitors. By December 2024, Gelsinger resigned under pressure, leaving Intel at a critical crossroads. Once a symbol of American chip dominance, Intel faces existential challenges as its integrated model is scrutinized.

Physical AI With Accelerated Robotics Simulation on AWS [NVIDIA]

NVIDIA has announced that its Isaac Sim runs on Amazon EC2 G6e instances powered by NVIDIA L40S GPUs, with NVIDIA OSMO for workflow orchestration. Unveiled at AWS re: Invent, this integration allows developers to scale AI-driven robotics development entirely in the cloud, addressing the growing demand for "physical AI"—AI models that can interact with and understand the physical world. Isaac Sim enables developers to model, test, and validate AI-powered robots in physics-accurate virtual environments. With the integration of L40S GPUs, performance has doubled compared to previous architectures, facilitating faster, more complex simulations as scene complexity increases. NVIDIA OSMO, a cloud-native orchestration platform, supports efficient management of robotics workflows from data generation to model training and deployment across AWS infrastructure. Field AI is an example using Isaac Sim and Isaac Lab to evaluate robot foundation models in settings like construction and mining, Vention employs the tool to develop and test robotics "skills" for small to midsize manufacturers and Cobot (Proxie) optimizes performance for AI-powered collaborative robots in dynamic OSMO environments. Other companies, such as Rendered.ai, SoftServe, Tata Consultancy Services (TCS), Aescape, and Cohesive Robotics, all leverage Isaac Sim for synthetic data generation, robot validation, and the development of advanced AI-driven systems for sectors like security, manufacturing, agriculture, and healthcare.

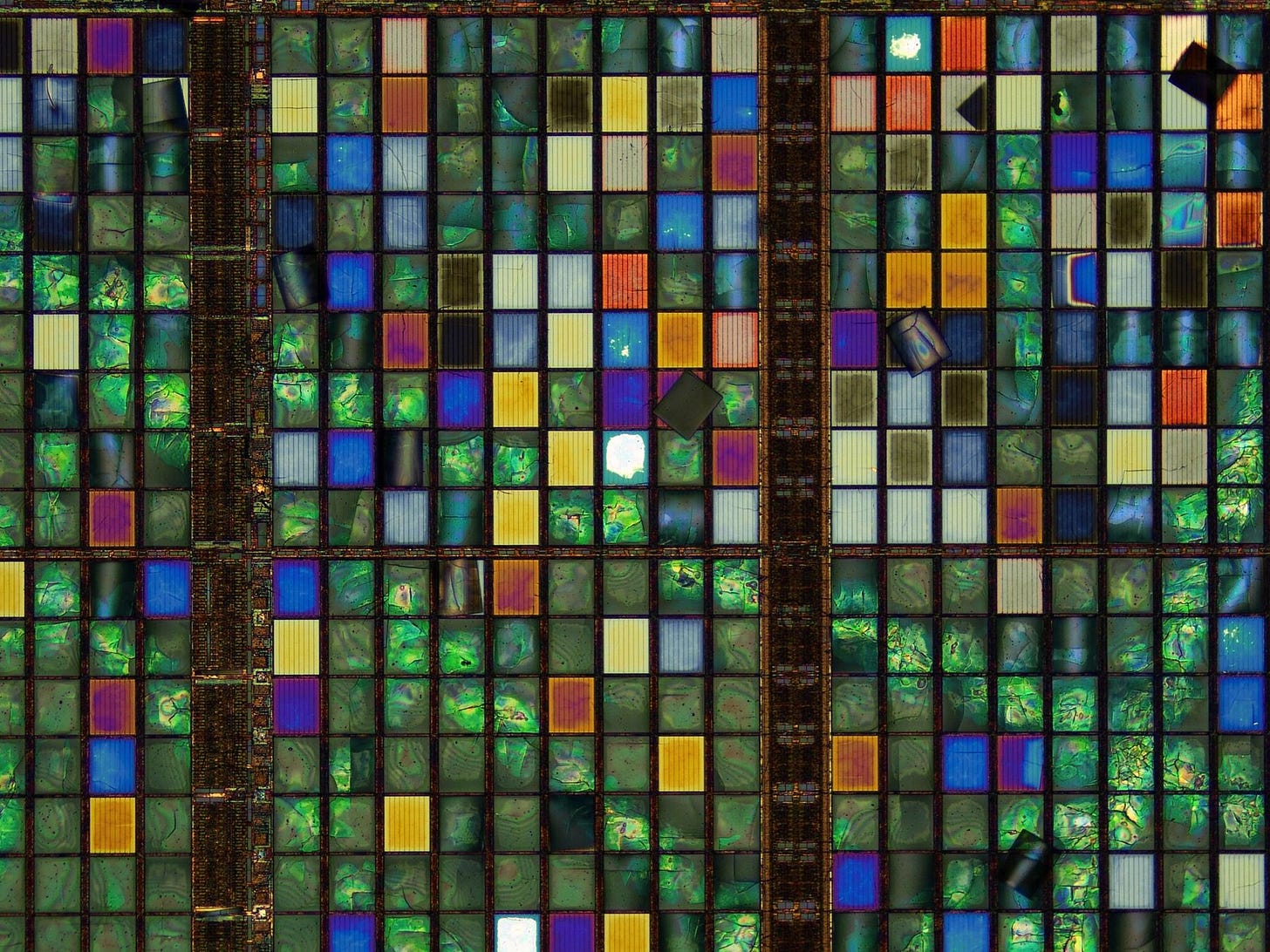

The Art of Failure Analysis 2024 [IEEE Spectrum]

Incredible photos from the Art of Failure Analysis from the International Symposium on the Physical and Failure Analysis of Integrated Circuits (IPFA).

Formnext 2024: All the New 3D Printers and Launches [3D Industry]

At Formnext 2024, major industry players are introducing advanced systems, materials, and solutions to boost additive manufacturing efficiency, quality, and flexibility. These new offerings and capabilities collectively underscore additives' continued advancement and emerging impact across sectors.

Renishaw’s latest RenAM 500 series system features advanced lasers and TEMPUS technology that allow simultaneous laser firing during recoating, reducing build times by up to 50%.

ARBURGadditive premiered the Freeformer 550-3X with the Gestica production assistant for streamlined operations, showcases the TiQ 8 printer for high-temperature materials, and demonstrates LSR printing with the LiQ 5 while also expanding its APF portfolio with Ultem 9085, TR 90, and multi-material components through the StarJet project.

CEAD unveiled its Large Format Additive Manufacturing solutions, integrating 3D printing with CNC milling for industry-focused applications, and offers new Flexbot updates to tackle wide-part production challenges.

Sharebot debuts its SnowWhite HT 3D printer for high-temperature and complex industrial materials, accompanied by the AI-driven IAmSharebot platform for workflow optimization.

Formlabs introduces ACMO-free Creator Series resins on the materials front, enabling safer and more affordable hobbyist printing with broad printer compatibility.

Fiberthree launched F3 PA ESD, a robust, conductive filament for sensitive electronics.

TRUMPF expanded its aluminum alloys for lightweight automotive, aerospace, and bicycle production.

Great Blogs:

Industrial Engineering w/ Carlos Vanegas

Manufacturing Is A War Now [Noahpinon]

Research

8,000 Designs to Get You Started Building The Car of the Future [MIT]

MIT engineers have publicly released DrivAerNet++, the largest open-source dataset of car designs and their aerodynamics, aiming to accelerate innovations in fuel efficiency and electric vehicle range. The dataset contains more than 8,000 distinct, physically accurate 3D car designs generated from baseline models provided initially by Audi and BMW. Each design is available in multiple data formats—meshes, point clouds, and parameter lists—so different AI models and simulations can easily use the data. The team ran computational fluid dynamics simulations for every design, computing how air flows around the car body. This aerodynamic performance data is included with each design. In total, generating the dataset required over 3 million CPU hours and produced about 39 terabytes of data, roughly quadruple the size of the entire printed Library of Congress. With thousands of realistic car forms and detailed aerodynamic simulations, engineers can train generative AI models to explore new design possibilities instantly. Furthermore, rapid prototyping supports the automotive industry’s push toward more efficient vehicles. Designers can ask an AI model to produce shapes that lower drag and improve fuel efficiency or EV range or quickly estimate the aerodynamic performance of a given design—without building and testing a physical car. The hope is that DrivAerNet++ spurs a new wave of AI applications in automotive engineering, ultimately helping to lower R&D costs, shorten design cycles, and pave the way for more sustainable transportation.

2025 Predictions:

2025 Manufacturing Industry Outlook [Deloitte]

2025 Manufacturing Industry Outlook [West Monroe]

2025 Oil and Gas Industry Outlook [Deloitte]

Podcasts/Video:

Flexibility for Frontline Workers w/Rahil at Wilya

Finance & Transactions 🏭💵

Public Industrial Tech:

Venture Capital:

Tractian - A hardware-software platform to give maintenance technicians and industrial decision-makers comprehensive oversight of their operations.

$120 million [Series C] - Led by Sapphire Ventures and joined by General Catalyst, Next47, and NGP Capital.

Amp Robotics - A company building AI-powered sortation to modernize the world's recycling infrastructure and maximize the value in waste.

$91 million [Series D] - Led by Congruent Ventures and joined by Liberty Mutual Investments CalSTRS with insiders Sequoia Capital and Wellington Management.

Cofactr - An automated electronic component procurement and inventory management platform for hardware manufacturing.

$17.2 million [Series A] - Led by Bain Capital Ventures and joined by YC, Floating Point Ventures, Broom, and DNX.

MakersHub - A company building an AI-powered platform is designed to streamline every step of the accounts payable workflow for industrials.

$7 million [Seed] - Co-Led by QED Investors and TTV Capital.

Fabri - a Boston-based advanced manufacturing startup focused on metal casting and foundry technology.

$5 million [Seed] - Led by Lavrock Ventures and joined by RTX Ventures, Tenon Ventures, and SBXi.

Planned Downtime 🏭🧑🔧

Severance Season 2 Trailer