Breaking the Bottleneck | Issue 71

[2/3/2024] Boom Supersonic, Battery Cell Factory of the Future & an Acquired interview with Morris Chang!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

💥 If you are building, operating, or investing in manufacturing, hardware, or robots, please reach out. My email is aditya@schematicventures.com – I’d love to chat!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🏭🗞️🔬 📚

News:

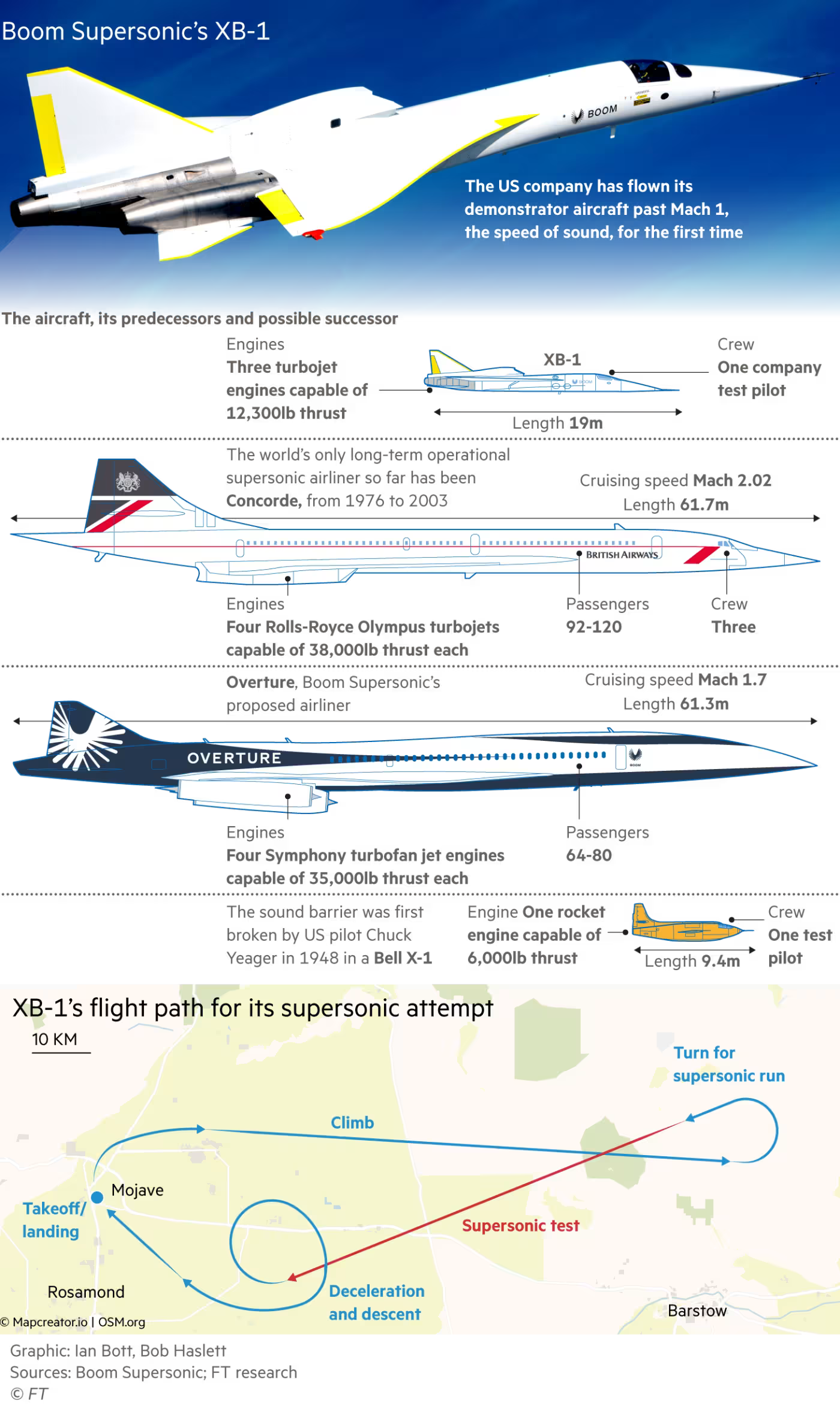

SFO to Tokyo in 6 Hours? Startup Breaks the Sound Barrier [SF Standard]

Boom Supersonic made history with its XB-1 jet breaking the sound barrier, marking the first U.S. civilian aircraft to do so. The Denver-based company aims to revive commercial supersonic travel with its Overture jet. It promises to cut flight times dramatically—such as reducing the SFO-Tokyo route from 11 to six hours. Boom envisions supersonic travel as mainstream, sustainable, and affordable but faces immense technical, regulatory, and economic challenges. Supersonic commercial flight has a troubled history, with the Concorde ultimately failing due to high costs, excessive fuel consumption, and regulatory hurdles, including sonic boom restrictions over land. Boom claims modern technology will resolve these issues, with Overture projected to be 75% cheaper to operate than the Concorde and optimized for 100% sustainable aviation fuel. However, skepticism remains, with only American Airlines making a nonrefundable deposit on 20 planes, while United and Japan Airlines hold nonbinding agreements. It must overcome significant financial and engineering barriers, with critics warning of a Boom following the fate of past aerospace startups like Aerion Corporation, which collapsed despite industry backing. CEO Blake Scholl insists Boom’s nimble, tech-driven approach will succeed where others failed, banking on cutting-edge engineering and sustained investor confidence.

New Neural Network Slashes Sensor-Data Overload [IEEE Spectrum]

Researchers at Pennsylvania State University and MIT have developed a neural network, the Shift-Invariant Spectrally Stable Undersampled Network (SIUN), that achieves over 90% accuracy while sampling as little as 10% of raw sensor data, significantly reducing storage and compute demands. With global IoT sensor data projected to reach 73 zettabytes by 2025, SIUN offers a way to process critical information more efficiently. Tested on fault detection datasets, SIUN classified faulty ball bearings with 96% accuracy, using only 30% of the original data. Comparatively, a traditional convolutional neural network (CNN) achieved 99.77% accuracy but required an entire dataset and 3 million parameters, whereas SIUN used just 42,000 parameters. SIUN’s efficiency led to a 435x reduction in FLOPS requirements and an 8- to 27-fold decrease in compute costs across multiple datasets. Researchers demonstrated real-world feasibility by deploying SIUN on a $4 Raspberry Pi Pico microcontroller with only 264 KB of RAM, showing its ability to run AI inference on ultra-low-power hardware. The technology has broad applications, from enabling AI sensing in rural manufacturing sites to reducing costs for space missions where hardware limitations and launch expenses (e.g., $6,000/kg for SpaceX’s Smallsat Rideshare Program) make traditional AI computing infeasible. Through their startup Lightscline, the team has filed multiple patents and aims to commercialize SIUN for industrial and extraterrestrial applications, illustrating its potential to revolutionize edge AI processing.

The Future of Manufacturing: AI for Data Standardization [Microsoft]

Microsoft and its partner Sight Machine are tackling the challenge of fragmented manufacturing data through AI-driven solutions integrated into Microsoft Fabric. As manufacturers generate vast amounts of sensor and machine data with inconsistent naming conventions, managing and integrating this information becomes increasingly complex. To address this, Sight Machine developed Factory Namespace Manager, a fine-tuned AI model based on Phi-3.5 SLM, designed to standardize factory data naming conventions and enable seamless integration with enterprise systems. Manufacturers can optimize operations and enhance decision-making by unifying disparate data schemas into a corporate-standard namespace. Microsoft’s Azure OpenAI Service allows for further fine-tuning of small language models to improve accuracy and efficiency in industrial applications, ensuring cost-effective deployment and responsible AI adherence. Additional tools include the Sight Machine Manufacturing Data Platform (MDP), which consolidates plant data across all sensors, machines, and production lines into a single source of truth. Factory CoPilot is a generative AI-powered assistant for real-time insights and root cause analysis. Another innovation, Sight Machine Blueprint, developed with NVIDIA and Microsoft, enables high-speed AI-driven data labeling, processing up to 100 times more data for enhanced decision-making. These advancements, powered by Microsoft Cloud for Manufacturing, transform how industrial data is managed, fostering efficiency, scalability, and enterprise-wide intelligence.

The Dumbest Trade War in History [WSJ Opinion]

Donald Trump’s plan to impose a 25% tariff on imports from Mexico and Canada while levying only a 10% tariff on China has sparked criticism over its economic rationale and potential consequences. While Trump justifies the move by citing drug trafficking concerns, this explanation ignores the long-standing nature of the issue and suggests that tariffs are being imposed for their own sake. His rhetoric often implies a vision of American autarky, disregarding the integrated nature of North American supply chains, particularly in the auto industry. In 2024, Mexico supplied nearly 42% of U.S. auto parts imports and Canada 13%, with vehicle components crossing borders multiple times during production, allowing manufacturers to optimize costs and enhance competitiveness. In 2023 alone, the North American auto trade added over $809 billion to the U.S. economy and supported 9.7 million jobs, with exports to Mexico and Canada rising to $86.2 billion. Tariffs could also disrupt the agricultural sector, where Mexico and Canada collectively account for 43% of U.S. food imports. Mexico, for instance, provides 90% of the avocados sold in the U.S., benefiting from American growers relocating due to labor shortages. Retaliation is likely, as Canada and Mexico have previously targeted politically sensitive U.S. industries, such as California wine, Ohio soy, and Kentucky bourbon, in response to past trade disputes. Canadian Prime Minister Justin Trudeau has vowed dollar-for-dollar countermeasures, which could increase costs for U.S. consumers. This tariff policy also undermines the U.S.-Mexico-Canada Agreement (USMCA), which Trump himself negotiated, raising doubts about the reliability of the U.S. treaty and discouraging future trade agreements. If implemented, a North American trade war could inflict severe economic damage, making it one of history's most counterproductive protectionist moves.

Research:

The Battery Cell Factory of the Future [BCG]

As global battery demand rises, the industry faces a looming overcapacity crisis, primarily driven by China’s rapid expansion. This could lead to production capacity exceeding demand by up to twofold over the next five years. This oversupply intensifies price competition, making cost efficiency a top priority for manufacturers, particularly in reducing conversion costs, which account for 20% to 30% of total battery production expenses. Regional disparities add complexity, with conversion costs for NMC batteries at $13 per kWh in China, $17 per kWh in the U.S., and $22 per kWh in Germany. To address these challenges, manufacturers are embracing the "factory of the future," leveraging automation, AI-driven quality control, and process innovations to cut conversion costs by up to 30%. Structural optimizations such as mini-environments reduce dry room costs, multi-floor layouts optimize space, and modular design enables flexible production upgrades. Technology innovations like continuous mixing boost slurry production efficiency by 300%, while infrared drying and electrode dry coating offer significant cost and energy savings. However, scaling them for commercial use remains a challenge.

Digitization and AI-driven process controls further enhance efficiency, with self-controlled slot die systems reducing material waste, AI-driven condition-based aging cutting battery aging times by up to 80%, and remote operating systems streamlining labor costs. Stronger OEM collaboration can reduce the 18-month approval cycle for manufacturing process changes, expediting innovation adoption. The factory of the future could lower conversion costs by 20% to 30%, particularly in electrode production, while reducing factory size by 40% without impacting output. However, net-zero emissions will require renewable energy and additional sustainability efforts. Key barriers include the difficulty of scaling new technologies like dry coating, knowledge gaps among new entrants, capital constraints, market volatility, and uncertainty around battery chemistries and form factors, with shifts between pouch and cylindrical cells potentially requiring 50-60% equipment replacement. To remain competitive, manufacturers must strategically adopt next-generation automation, AI, and modular design, ensuring a 30% cost reduction and a strong position in an increasingly overcrowded market.

Gen AI: A Game Changer for Biopharma Operations [McKinsey]

Generative AI (Gen AI) is rapidly gaining traction in biopharmaceutical operations, with over two-thirds of major companies planning to increase investments in the technology over the next three years. McKinsey estimates that Gen AI could generate $4 billion to $7 billion annually through workload reductions, cost savings, improved equipment effectiveness, and quality enhancements. Despite the industry's vast data repositories, few companies have realized tangible benefits, raising concerns about whether they are targeting high-impact areas. Biopharma’s digital transformation efforts, such as in silico models and process automation, have laid the groundwork for Gen AI, which presents new opportunities across three categories: entry-level use cases available via off-the-shelf solutions, novel use cases requiring domain-specific customization, and frontier use cases demanding real-time numerical processing with stringent regulatory oversight. Immediate applications include optimizing shop floor efficiency, where AI copilots can automate equipment diagnostics, shift coordination, and reporting tasks. Early implementations have reduced breakdown time, speed losses, and stoppages by 5%, decreased execution time by 30%, and cut corrective maintenance workload by 40-50%. AI-driven deviation management tools, addressing a process that consumes 4-6% of manufacturing site resources and causes 65% of drug shortages, have reduced recurring and critical deviations by 30-40%, accelerated deviation closure times by 40%, and decreased quality-related write-offs by 10-30%. Additionally, Gen AI has the potential to revolutionize product development by acting as a centralized hub for process intelligence, leveraging historical unit operation designs, optimizing process parameters, automating documentation, and facilitating technology transfers. Traditional AI models have shortened investigational new drug (IND) timelines by nearly one-third and increased development efficiency by 40%, suggesting even greater efficiency gains with Gen AI.

Beyond manufacturing, Gen AI can optimize supply chain performance, where fragmented data often leads to stockouts, delays, and inefficiencies. AI-powered copilots can integrate and analyze supply chain data, improving forecast accuracy by 15%, reducing supply chain costs by 2-3%, and lowering planner workloads by 20-30%. However, widespread Gen AI adoption presents challenges, including AI-generated errors ("hallucinations"), requiring human oversight, and regulatory constraints demanding stringent risk assessments for tasks like batch release and quality audits. Additionally, Gen AI is unsuitable for high-volume, time-sensitive tasks, such as real-time production monitoring, and is vulnerable to intellectual property risks, algorithmic bias, and compliance issues. Workforce training is critical, ensuring engineers, operators, and technicians can validate AI outputs. To unlock Gen AI’s full potential, biopharma companies must establish structured data infrastructure, implement AI governance, train personnel, develop compliance frameworks, integrate technology seamlessly, and foster a culture of continuous innovation. Companies that proactively address these challenges can accelerate drug development, enhance operational efficiency, and improve patient outcomes. While the regulatory and technical landscape remains complex, the potential for Gen AI to transform biopharma operations is immense, marking the dawn of an intelligent, automated, and AI-driven future.

Podcasts/Video:

A Rare Interview with Morris Chang [Acquired]

Finance & Transactions 🏭💵

Venture Capital:

Skild AI - A company building general purpose robotic intelligence.

$500 million [Venture] - Led by Softbank

UV Eye - A company building computer vision tech for automated inspection systems for vehicles, across the entire vehicle lifecycle.

$41 million [Series C] - Led by Woven Capital and joined by UMC Capital, MyBerg, and insiders W.R. Berkley, Menora Mivtachim, and More Investment House

Tive - A company offering a cloud platform, patented sensor technology, and 24/7 Live Monitoring services to reduce excursions and delays, minimize rejected loads, and decrease theft, damage, and spoilage across the supply chain.

$40 million [Series C] - Co-led by WiL & Sageview Capital and joined by AVP, RRE Ventures, Two Sigma Ventures, Qualcomm Ventures, Fifth Wall, Supply Chain Ventures, and Sorenson Capital.

Planned Downtime 🏭🧑🔧

White Lotus Season 3 Trailer