Breaking the Bottleneck | Issue 78

[4/14/2024] NVIDIA, Siemens + Dotmatcs, State of Food Manufacturing & More!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

💥 If you are building, operating, or investing in manufacturing, supply chain, or robots, please reach out. I’d love to chat [Aditya Raghupathy]!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🗞️🔬 📚

News:

How nTop Uses Accelerated Computing to Enhance Product Design [NVIDIA]

nTop, founded by Bradley Rothenberg, has revolutionized the CAD industry by developing a GPU-native engineering software platform that enables fast, high-volume iterative design using AI and parallel computing. Unlike traditional CPU-based CAD tools, nTop leverages the power of NVIDIA's CUDA-X libraries, Modulus, and Omniverse libraries to allow product developers to run hundreds of design simulations, rapidly assess performance trade-offs, and autonomously optimize designs in real time. The result is a scalable design process that empowers innovation across industries. nTop’s tools allow for AI-driven geometry and physics modeling, enabling companies to train neural networks on their proprietary design data for highly customized and efficient design iterations. The impact is already evident in major applications: U.K. grocery tech company Ocado redesigned 16 robot components in one week using nTop, cutting robot weight by two-thirds and improving warehouse efficiency. Similarly, a Formula 1 team used nTop to develop a heat sink with 3x the surface area and 25% less weight than traditional designs, improving performance and aerodynamics. Looking ahead, the company aims to expand its adoption by integrating implicit modeling with customers’ proprietary data to deliver real-time design collaboration between humans and AI.

Siemens to Acquire Dotmatics [Machine Maker]

Siemens AG has acquired Dotmatics, a Boston-based R&D software leader in the Life Sciences sector, for $5.1 billion, significantly enhancing Siemens’ AI and Digital Twin capabilities. Dotmatics provides an enterprise R&D platform, widely used by over 14,000 customers and more than 2 million scientists globally, to accelerate drug development through advanced data management and collaboration tools. Siemens anticipates Dotmatics contributing over $300 million in revenue by 2025, driven by the software’s strong profitability, and expects annual synergies to reach approximately $100 million in the medium term, eventually surpassing $500 million in the long term. Siemens will primarily finance the acquisition by divesting subsidiary shares, including Siemens Healthineers. The acquisition significantly expands Siemens’ addressable software market by $11 billion, tapping into trends such as aging populations, healthcare accessibility, and the rising complexity of drug discovery, with software spending in Life Sciences projected to double within five years. The integration aligns with Siemens’ ONE Tech program, aiming for innovation in high R&D sectors, particularly AI-driven industries, strengthening its strategic growth areas in AI, connected hardware, and sustainability.

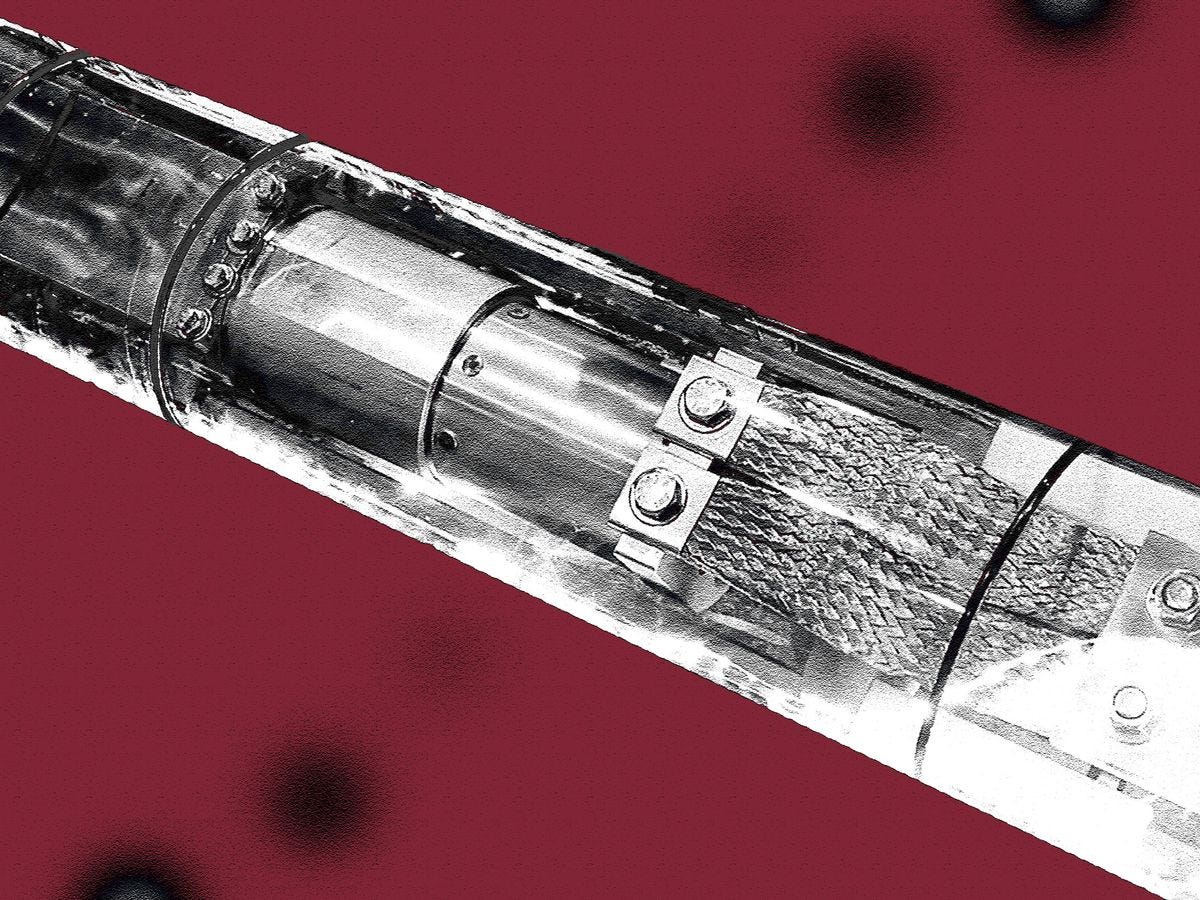

First Supercritical CO2 Circuit Breaker Debuts [IEEE Spectrum]

Researchers at Georgia Tech are developing a groundbreaking high-voltage circuit breaker that uses supercritical carbon dioxide (CO₂) instead of the harmful greenhouse gas sulfur hexafluoride (SF₆), commonly used in conventional grid-scale circuit breakers. SF₆, while highly effective as an insulator, has a greenhouse warming potential nearly 25,000 times greater than CO₂ and decomposes into toxic byproducts. The new breaker utilizes supercritical CO₂, dense CO₂ under high pressure and temperature, to effectively quench electrical arcs and interrupt current flow during faults. The prototype, rated at 72-kV, will undergo testing starting in late April at the University of Wisconsin-Milwaukee, with a 245-kV version also under development. The major engineering challenge was designing components capable of withstanding the high pressures of supercritical CO₂, particularly the electrical bushing, which the Georgia Tech team custom-built using mineral-filled epoxy, copper, and steel. This innovation could significantly reduce greenhouse gas emissions from the hundreds of thousands of circuit breakers installed worldwide. However, it will face competition from GE Vernova’s existing SF₆-free circuit breakers, which use a gas mixture including a lower-impact fluorinated compound (C4F7N). Both methods still rely on mechanical switching, slower than emerging semiconductor-based solid-state circuit breakers that can quickly interrupt faults. However, these solid-state systems currently operate effectively only at lower voltages.

NVIDIA to Manufacture American-Made AI Supercomputers [NVIDIA]

NVIDIA is partnering with manufacturers including TSMC, Foxconn, Wistron, Amkor, and SPIL to produce AI chips and supercomputers entirely in the United States for the first time. Over a million square feet of manufacturing space has been commissioned for NVIDIA's Blackwell chips in Arizona and AI supercomputers in Texas. Production has already begun at TSMC’s Phoenix plant, with mass production in new Foxconn and Wistron Texas plants expected within 12-15 months. The initiative is projected to produce up to half a trillion dollars in AI infrastructure over the next four years, creating hundreds of thousands of jobs and significantly boosting economic security. NVIDIA's advanced technologies, including AI, robotics, digital twins via NVIDIA Omniverse, and robotic automation through NVIDIA Isaac GR00T, will be integral to operating these new factories.

Inside Factories in China, a Struggle to Survive Trump’s Tariffs [NY Times]

Thousands of small, export-focused factories in Guangzhou, crucial to China’s economic growth, are struggling amid President Trump’s escalating tariffs on Chinese imports. Clothing manufacturers face canceled orders from American buyers, resulting in mounting losses and unsold inventory. While some garment factories have already temporarily closed, others urgently seek customers in new markets or domestically, despite facing intense price competition and weak local demand due to the downturn of China’s housing market. Factories producing specialized machinery, such as low-cost cooking equipment, feel somewhat insulated since competitors elsewhere use more expensive materials, but uncertainty remains widespread. Rising tariffs now reaching 125% in under three months pose limited threats to some manufacturers whose production costs represent a small fraction of US retail prices. However, persistent labor costs, driven by a demographic shortage of young workers, compound the challenges. Despite difficulties, many factory owners retain confidence in China’s economic resilience and long-term prospects.

Surging Costs Complicate Plans for New US Factories [WSJ]

Trump’s recent tariff expansion has disrupted factory construction projects across the US, significantly increasing costs for building materials and imported machinery. Companies already investing in new manufacturing facilities, such as roofing products maker IKO North America and detergent manufacturer Earth Breeze, are facing escalating expenses and delays. For instance, IKO must now pay higher prices for steel used in roofing shingles, and Earth Breeze expects an additional $250,000 bill due to tariffs on imported machinery. A $300 million plastics recycling plant in Erie, Pennsylvania, was canceled due to these unexpected cost hikes and delayed federal loan guarantees. Construction firms estimate substantial price hikes: metal panels, structural steel, and metal studs could rise 20%-30%, drywall 20%, plumbing equipment 10%, and electrical gear, roofing products, and HVAC components will also become significantly more expensive. Experts warn these increases might drive some projects out of financial viability entirely. Despite the government’s intent to encourage domestic sourcing and revive US manufacturing through tariffs, industry professionals and economists caution that the strategy is risky, inflationary, and could ultimately backfire by raising consumer prices and limiting manufacturing expansion.

Trump’s Dreams Clash With Business Owners’ Reality [Bloomberg]

President Trump’s tariffs, aimed at encouraging US manufacturing, are prompting American businesses to reconsider their international supply chains. However, many find domestic production still infeasible due to higher costs, limited capacity, and insufficient technological capabilities. Evita Chu, owner of PDR Knitting, explored sourcing yarn domestically but found US mills lacked the necessary technology and suitable order sizes, forcing her to continue relying on international suppliers despite increased tariffs. Similarly, YouCopia’s Lauren Greenwood calculated that despite tariffs making US production potentially 20% cheaper, hidden costs like relocating manufacturing tools, finding packaging suppliers, higher labor costs, and uncertainty caused by frequent tariff changes outweighed the benefits, pushing her to stick with Chinese manufacturing or consider Vietnam. Megan Graham of Ries also encountered significant barriers, such as the high cost and logistical challenges of moving specialized plastic moldings from China to the US and the lack of local expertise to manage them. While some companies, like Vacane Home Concepts, are successfully establishing US operations, it’s a long, costly, and complex process, often resulting in only a tiny fraction of total production shifting stateside. Despite Trump’s intent to boost domestic manufacturing, significant structural barriers remain, highlighting that tariffs alone may not be sufficient to drive a true American manufacturing resurgence.

Research:

Supply Chain Volatility Index [GEP]

Podcast:

US Manufacturing Is In A Tough Spot [WSJ]

Finance & Transactions 💵

Venture Capital:

BasePower - A company building America’s next-generation power and driving grid resilience through partnerships with utilities and homebuilders.

$200 million [Series B] - Co-led by Addition, Andreessen Horowitz, Lightspeed Venture Partners, and Valor Equity Partners

Nuro - A leader in autonomous driving technology.

$106 million [Series E] - From T. Rowe Price, Fidelity, Tiger Global Management, and Greylock Partners

Rescale - A company building the unified digital engineering platform.

$115 million [Series D] - From Applied Ventures, Atika Capital, Foxconn, Hanwha, Hitachi, NEC, NVIDIA, and Prosperity7.

AMCA - A company focused on designing and manufacturing the products that sit between standardized parts and full systems for aerospace.

$76 million [Seed] -From Caffeinated Capital, Founders Fund, Lux Capital, Andreessen Horowitz, and others.

Optilogic - A company building an AI powered platform to help companies design and optimize their supply chains.

$40 million [Series B] - Led by NewRoad and joined by MK Capital and Moore Strategic Ventures.

Zero Industrial - A a developer of industrial decarbonization projects, utilizing thermal energy storage technologies.

$10 million [Series A] - Led by Evok Innovations and joined by Rusheen Capital Management.

Planned Downtime 🧑🔧

Frontiers of AI and Computing with Yann Le Cunn