Breaking the Bottleneck | Issue 79

[4/21/2024] SMRs in the US, Luminary's SHIFT-SUV Model, BCG's Packaging Playbook & More!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

💥 If you are building, operating, or investing in manufacturing, supply chain, or robots, please reach out. I’d love to chat [Aditya Raghupathy]!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🗞️🔬 📚

News:

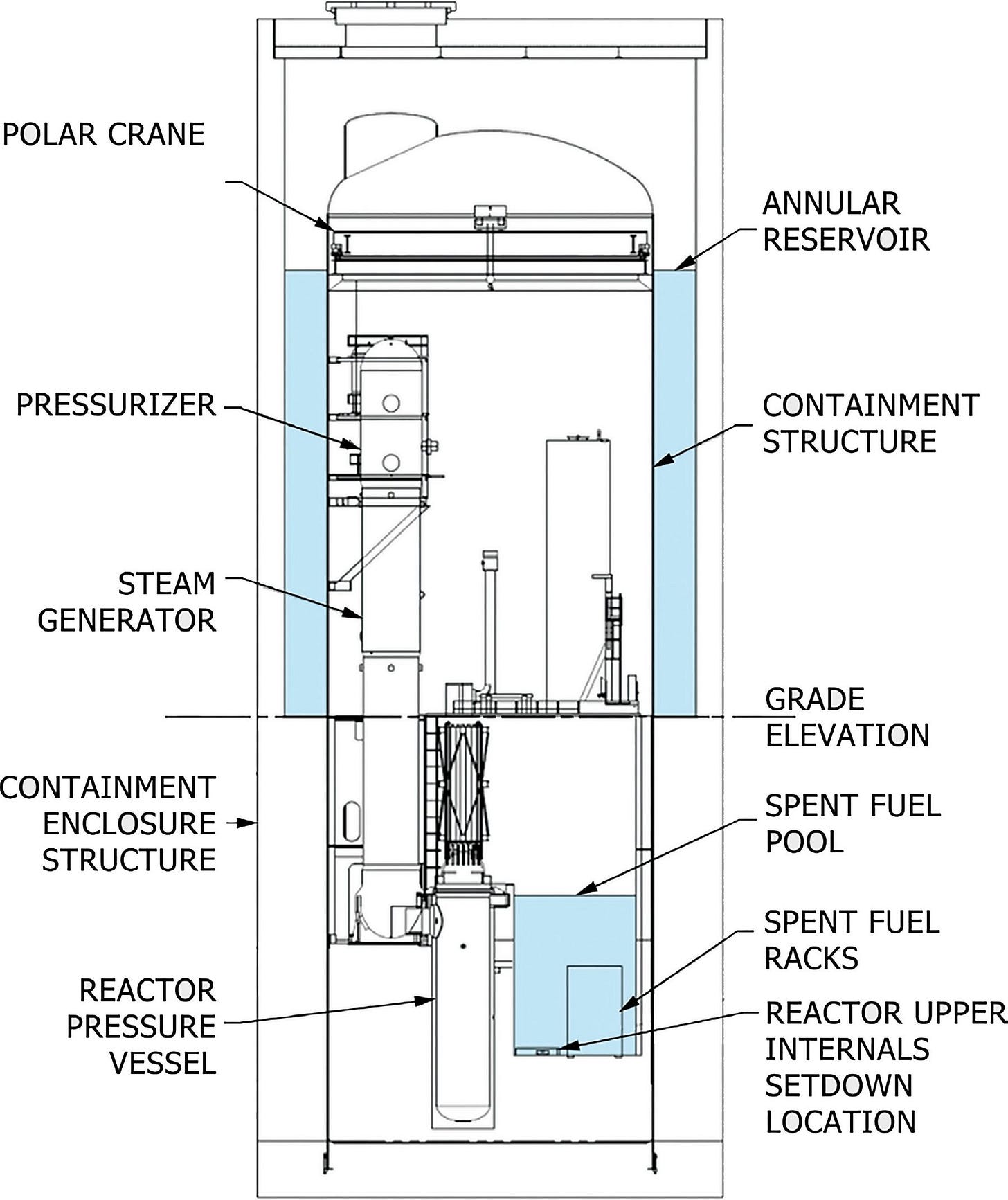

US Pushes $900M for Small Modular Reactors [IEEE Spectrum]

The US Department of Energy (DOE) has launched a $900 million funding initiative to accelerate the commercialization of small modular reactors (SMRs), specifically advanced Generation III+ designs using light-water coolant and low-enriched uranium fuel. Initially introduced by the Biden administration, the program has since been amended under President Trump to remove community benefit requirements and evenly balance technical and commercial evaluation criteria. The program seeks “first mover” projects, $800 million, that can demonstrate clear, viable deployment plans by the early 2030s, including robust financial, licensing, and construction strategies and secured supply chains and local support. Another $100 million is earmarked for earlier-stage “fast follower” projects tackling supplier readiness and feasibility studies. Several companies are likely contenders for DOE funding, including NuScale, which holds the only current NRC-approved SMR design but has faced recent cancellations due to rising costs; GE Hitachi, whose BWRX-300 is advancing in Canada with potential deployment at TVA’s Clinch River site; and Holtec International, planning to deploy its SMR-300 at Michigan’s Palisades facility by 2030–2031. Despite this federal support, substantial hurdles remain, including investor hesitancy due to the nuclear industry’s track record of cost overruns, long project timelines, and uncertain regulatory landscapes. MIT expert Jacopo Buongiorno highlights that ultimate success for these SMRs will hinge on delivering reactors on schedule, within budget, and meeting performance expectations milestones not yet achieved by any US SMR project.

NVIDIA to Make AI Supercomputers in the US [Fast Company]

Nvidia announced it will manufacture its AI supercomputers in the US for the first time, commissioning over one million square feet of production space in Arizona and Texas. The initiative, centered around its Blackwell chips and AI supercomputers, is projected to yield up to $500 billion in AI infrastructure over the next four years. Nvidia is partnering with Taiwan Semiconductor Manufacturing Co. for chip production in Phoenix, and Foxconn and Wistron to build supercomputers in Houston and Dallas, respectively. Mass production is set to scale within 12–15 months. Additional packaging and testing will be done in Arizona with partners SPIL and Amkor. The announcement aligns with broader Trump administration efforts to revive US manufacturing and reduce reliance on foreign semiconductor supply chains. While temporary exemptions on consumer electronics tariffs remain, officials have signaled that new semiconductor-specific tariffs are imminent. The White House credited Nvidia’s move due to the “Trump Effect,” noting that Trump’s push for domestic chip production has catalyzed trillions in tech-sector investments. This includes Stargate, a $500 billion joint venture from OpenAI, Oracle, and SoftBank aimed at building AI infrastructure and power generation in Texas, with $100 billion in initial funding already committed.

AI Tackles SUV Aerodynamics [Engineering.com]

Luminary Cloud has unveiled SHIFT-SUV, a new physics-based AI foundation model designed to accelerate automotive aerodynamic design by eliminating the need for traditional, time-intensive CFD simulations. Developed in collaboration with Honda and trained on over 1,000 parametrically modified versions of the AeroSUV reference model, SHIFT-SUV uses Nvidia’s PhysicsNeMo framework to provide near-instant predictions of aerodynamic performance from geometry variations. This enables designers to bypass tasks like mesh generation and solver setup, allowing faster iteration in early-stage design. The company is releasing both the SHIFT-SUV model and its training dataset as open source, encouraging community contributions. Luminary plans to scale the dataset to include 25,000 SUV geometry variations by year-end. The model is already integrated into tools like Blender for real-time inference and builds on Luminary Cloud’s broader AI-driven simulation initiatives, including recent collaborations with Nvidia and nTop on geometry-to-simulation-to-AI pipelines and a virtual wind tunnel demo introduced last year.

ABB to Spin Off Biggest Robotics Business [Reuters]

Swiss industrial giant ABB announced plans to spin off its robotics division, marking its most significant restructuring since selling its power grids business to Hitachi in 2018. ABB’s robotics unit, the world’s second-largest after FANUC, generated $2.3 billion in sales in 2024 (7% of ABB’s total revenue), but has recently struggled due to weak demand in the automotive sector and uncertainties stemming from tariffs under President Trump’s administration. The spin-off, set for Q2 2026, will establish the robotics unit as a separately listed company, with shares distributed to ABB investors as dividends. ABB is considering listing in Sweden or Switzerland, but no final decision has been made yet. ABB CEO Morten Wierod believes the standalone company will achieve better performance and greater value creation, emphasizing rising labor costs and skilled labor shortages as long-term growth drivers for robotics. Investor AB, ABB’s largest shareholder (14.3%), supports the move as logical. Analysts at Bank Vontobel estimate the robotics division’s enterprise value to be $2.7–$3.3 billion. ABB’s stock rose 3.5% after the announcement, which coincided with Q1 2025 earnings reporting a 13% EBITA increase to $1.59 billion, though sales slightly missed expectations, rising just 1% to $7.94 billion.

How a 1980s Toy Arm Inspired Modern Robotics [MIT Tech Review]

The article explores the fascinating history and lasting impact of the Armatron, a beloved robotic arm toy introduced by Radio Shack in the early 1980s. Designed by Japanese engineer Hiroyuki Watanabe at Tomy (now Takara Tomy), the Armatron was notable for its purely mechanical operation. It was powered entirely by a single small motor, intricate gearboxes, and joysticks that allowed precise, articulated movements. Watanabe was inspired by hobbyist radio-controlled helicopter controls, innovatively designing the Armatron to have multiple motions from just two joysticks. This remarkable mechanical design captivated kids and caught the attention of robotics researchers and engineers at universities and companies. Adam Borrell of Boston Dynamics credits the Armatron with sparking his lifelong passion for robotics, and Eric Paulos, a professor at UC Berkeley, continues to appreciate its mechanical ingenuity. Today, the Armatron thrives through online communities and enthusiasts modifying it for modern uses. Watanabe, now retired, expressed happiness that his creation continues to inspire curiosity and fascination, underscoring the lasting legacy of this iconic analog toy.

Research:

Humanoid Robots at Work [Bain]

Humanoid robots with advanced dexterity and general intelligence are rapidly becoming economically viable and are expected to reach cost parity with human labor within five years. Four factors, human-level mobility and dexterity, simplified AI-driven training, rapidly falling costs, and the integration of generative AI, are accelerating adoption across industries like manufacturing, healthcare, food service, and construction. Humanoid robots have unique advantages due to their compatibility with existing human-designed infrastructure, versatility in performing diverse tasks, and ability to operate continuously, significantly increasing productivity. The growing deployment of humanoid robots is driven by demographic shifts, such as aging populations and shrinking labor forces in developed economies, resulting in significant labor shortages and a growing appetite for automation. High-income countries’ efforts to boost domestic manufacturing through tariffs and subsidies will further spur demand for robotics, especially as traditional skill sets diminish. Investment in humanoid robotics has surged, reaching $1.1 billion in 2024, with market projections between $38 billion and over $200 billion by 2035. While widespread adoption isn’t imminent, executives across industries should begin strategic planning, experimentation, and assessment to understand how these advancements will reshape their operations and competitive landscape.

The New Playbook for Packaging in North America [BCG]

The North American packaging industry is currently at a crossroads, pressured by geopolitical disruptions from U.S. tariffs and increasing scrutiny over environmental impacts. These pressures have led many companies toward short-term defensive strategies focused on insulating margins, mitigating tariff impacts, and maintaining supply resilience at the expense of long-term sustainability transitions. However, proactive players can still capture growth opportunities by anticipating long-term shifts driven by five key megatrends: geopolitical changes reshaping trade, consumer preferences for convenience, rapid e-commerce growth, increasing consumer emphasis on health and wellness, and rising regulatory and consumer pressures for sustainability. These trends create market dynamics where paper and flexible plastics are positioned to gain market share, while rigid plastics and metal packaging face challenges due to cost volatility, tariffs, and sustainability concerns. Packaging companies must adopt a strategic long-term approach to successfully navigate this disruptive environment, focusing on future-proofing their product portfolios by anticipating evolving consumer and regulatory trends. Building agile and resilient supply chains through domestic sourcing, optimizing network design, and securing recycled inputs will be crucial for managing costs and mitigating tariff impacts. Additionally, adopting more innovative pricing structures and developing closer collaboration with consumer goods manufacturers for sustainable innovation will position companies for competitive advantage. Investing in R&D across core and breakthrough sustainability innovations, and actively managing M&A strategies to balance acquisitions of innovative startups and established sustainability leaders, will further prepare packaging companies to thrive amidst ongoing geopolitical and environmental disruptions.

Reach Gold-standard Operations in Pharmaceutical Manufacturing [EY]

The “golden batch” methodology transforms pharmaceutical manufacturing by establishing an ideal production run that is a consistent benchmark, helping companies enhance quality, efficiency, and regulatory compliance. It enables process standardization, minimizes variability, facilitates quick identification of deviations, and ensures comprehensive documentation and traceability, which are critical for meeting stringent compliance standards and maintaining customer trust. Furthermore, the golden batch approach supports predictive maintenance and preventive analytics, significantly reducing operational costs, minimizing downtime, and driving innovation, thus strengthening pharmaceutical companies’ ability to respond to dynamic market demands. Implementing the golden batch methodology requires leveraging process analytical technology, real-time monitoring, artificial intelligence, machine learning, and digital twins to transition from reactive systems to predictive and adaptive manufacturing environments. Organizations assess their digital maturity using frameworks like the Digital Plant Maturity Model (DPMM), which helps them identify the necessary steps toward a digitally connected, predictive, and ultimately self-optimizing operational model. To achieve sustained success with golden batches, pharmaceutical manufacturers must continuously integrate emerging technologies, build robust data architectures, and foster a culture of continuous learning, creating resilient, efficient, and compliant production systems.

Podcast:

We’re Getting China Dangerously Wrong [Ezra Klein Show]

Finance & Transactions 💵

Venture Capital:

Mainspring Energy - A company that designs, manufactures, and delivers advanced, onsite power generation solutions.

$258 million [Series F] - Led by General Catalyst and joined by Amazon's Climate Pledge Fund and Temasek

Arena AI - A company building an AI platform for hardware testing and optimization.

$30 million [Series B] - Led by Initialized Capital, Fifth Down Capital, and Goldcrest Capital

Revel - A company building software for controlling critical hardware.

$30 million [Series A + Seed] - Led by Thrive and joined by Felicis Ventures and Abstract Ventures

Doss - A company building a modern adaptive ERP and data platform.

$18 million [Series A] - Led by Theory Ventures

Blue Water Autonomy - A company building full-stack autonomy suite and for captain-less naval ships.

$14 million [Seed] - Led by Eclipse, Riot, and Impatient Ventures

Frontline.io - A company building and expert communication platform that guides the field personnel using AR, MR, video, annotation, and chatting tools.

$10 million [Series A] - Led by FIT Ventures and Click Bond

Xaba - A company building synthetic "brains" for industrial robots.

$6 million [Seed] - Led by Hitachi Ventures and joined by Hazelview Ventures, BDC Capital, Exposition Ventures, and Impact VC

RLWRLD - A company building a foundational AI model built specifically for robotics.

$14.8 million [Series A + Seed] - Led by Hashed and joined by Mirae Asset Venture Investment and Global Brain.

Cosmic Robotics - A company building a robotic assistant that does the heavy lifting on solar job sites.

$4 million [Seed] - Led by Giant Ventures and joined by HCVC and MaC Ventures

Planned Downtime 🧑🔧

Eddington Trailer