Breaking the Bottleneck | Issue 81

[5/12/2024] Rapid Liquid Print, Amazon Vulcan, The Techno-Industrial Playbook, Physical Turing Test, & More!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, and a startup database!

💥 If you are building, operating, or investing in manufacturing, supply chain, or robots, please reach out. I’d love to chat!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🗞️🔬 📚

News:

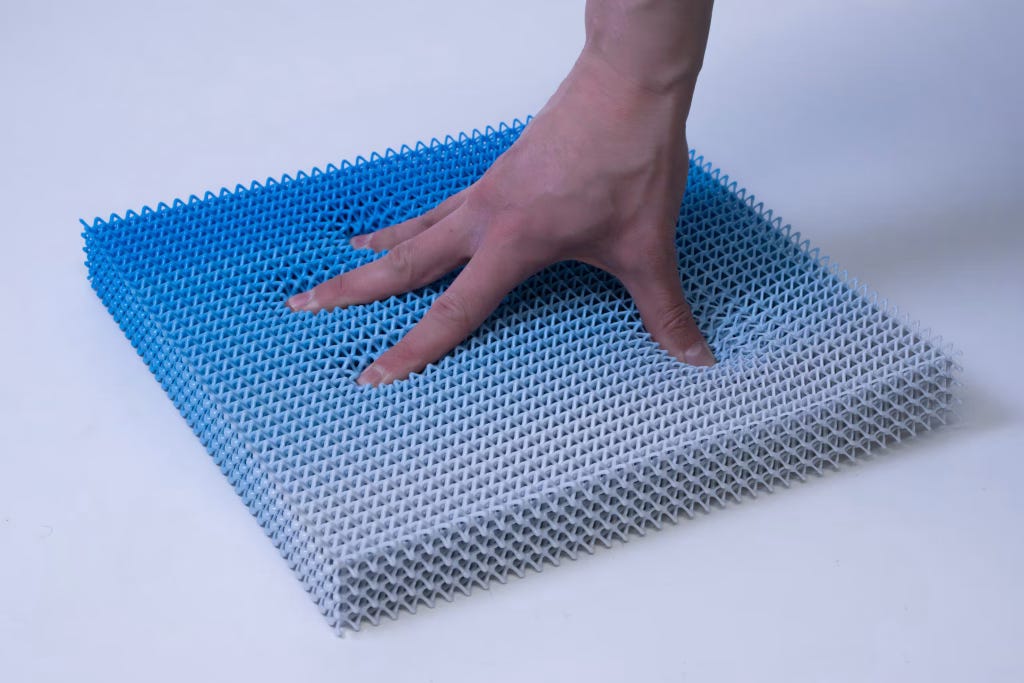

An Interview with Rapid Liquid Print [CDFAM]

Rapid Liquid Print (RLP), a spinoff from MIT’s Self-Assembly Lab, has developed an innovative additive manufacturing process that extrudes silicone into a viscous gel, eliminating the need for support structures by effectively negating the effects of gravity. Unlike traditional layering methods, RLP enables the creation of continuous, multi-surface geometries with isotropic properties, minimal post-processing requirements, and variable stiffness. At CDFAM Amsterdam, RLP showcased its collaboration with fashion brand Coperni, producing the Ariel Swipe Bag, whose iconic double-curved geometry was uniquely suited to RLP’s technology, allowing the complex shape to be printed seamlessly and functionally. Insights from the Swipe Bag project, such as balancing rigidity and flexibility, automatic geometric decomposition for continuous printing, and reinforced functional openings, have directly informed RLP’s typical medical and automotive applications, including custom prosthetic liners, seals, and cushioning components. RLP specializes in medium-to-large silicone parts requiring soft elastomeric properties and rapid production times, uniquely enabling unsupported cavities, complex intersections, and seamless gradients of hardness and color within single isotropic parts. The company continues refining its approach to computational design and additive manufacturing, inviting industry collaborations to explore new applications further and push technological boundaries.

Caterpillar, a New Era of Manufacturing & Assembly [Assembly Mag]

In the 1970s, Caterpillar Tractor Co. faced transformative challenges from increased globalization, regulatory pressures from agencies such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA), and growing foreign competition, prompting significant innovations and operational changes. Caterpillar maintained industry dominance through extensive R&D investments, introducing groundbreaking products like its hydraulic excavators in 1972 and the elevated drive sprocket system on the D10 tractor in 1978. Factory conditions were modernized to incorporate improved safety, ergonomics, and environmental standards, featuring advanced ventilation, noise reduction technologies, and innovative smoke-extraction welding guns. Assembly lines at facilities like Aurora and Mossville embraced automation, computerized quality control, and ergonomic tools, significantly enhancing production efficiency and employee safety. The competitive pressures of the 1980s compelled Caterpillar to undertake more radical operational shifts, including downsizing facilities, closing numerous plants in the Midwest, and launching the $2.1 billion “Plant With a Future” initiative. This initiative introduced continuous flow manufacturing, cellular production layouts, robotic welding systems, automated guided vehicles, and lean practices, resulting in a drastic reduction in inventory levels, assembly times, and overall costs. Despite intense labor disputes and competition from companies like Komatsu, Caterpillar emerged leaner and technologically advanced, driven by continuous improvement methodologies including Six Sigma and the Caterpillar Production System. Recent years have seen further strategic shifts toward non-union facilities in southern states, increased robotics and automation, and a sustained commitment to operational excellence, safety, and agility within its global manufacturing and distribution network.

How COVID-19 Changed US Manufacturing: 5 Years Later [Manufacturing Dive]

The COVID-19 pandemic fundamentally reshaped U.S. manufacturing, prompting companies to strengthen supply chain resilience, integrate more automation and AI tools, and redesign jobs to attract and retain workers. Initially, factories faced severe disruptions, with manufacturing employment plummeting by 1.3 million jobs; however, a subsequent rebound exceeded pre-pandemic employment levels by 2022. To mitigate ongoing labor shortages, manufacturers increasingly adopted automation and robotics, upgraded job roles with technology to attract younger workers. They shifted toward predictive maintenance to enhance productivity and reduce worker strain. Supply chain disruptions taught companies critical lessons about risk management, prompting them to make deeper investments in inventory management and supplier relationships. Many manufacturers moved away from lean, just-in-time models toward greater stockpiling, nearshoring, and real-time supply chain visibility through advanced analytics and digitization. Executives at companies like McElroy Manufacturing emphasized that strengthening supplier partnerships and maintaining higher inventory buffers enabled them to respond more quickly to fluctuating demand. The pandemic also raised public awareness about the importance and complexity of supply chains.

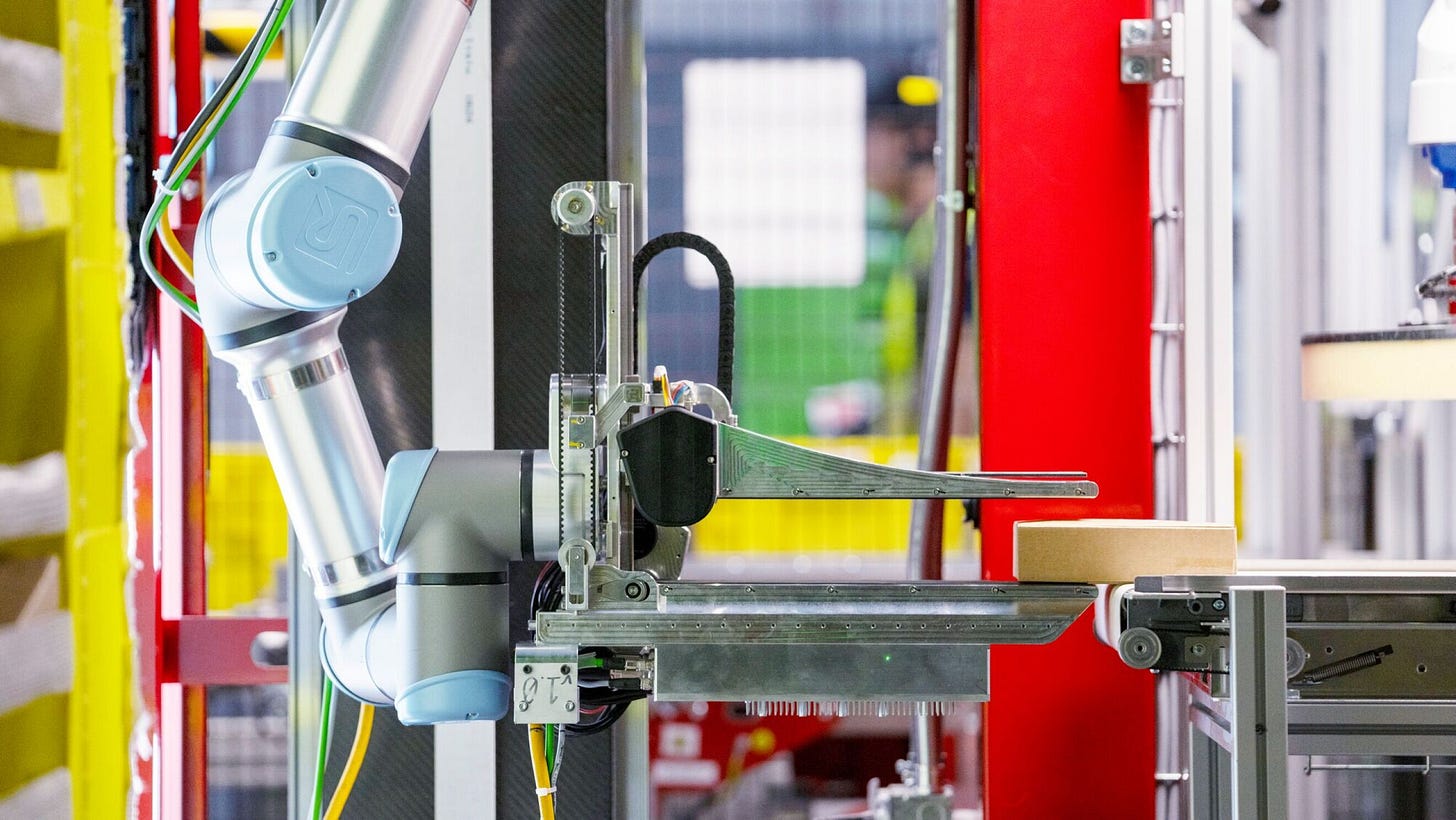

Vulcan, Amazon’s First Robot With a Sense of Touch [Amazon]

Amazon’s warehouses combine high organization with apparent chaos, storing items randomly in small bins to optimize for space and efficiency. While humans excel at extracting items from such cluttered bins, robots historically struggle due to difficulties in sensing, identifying, and manipulating objects. Amazon recently unveiled “Vulcan,” a robotic system that can now both stow and pick items at speeds comparable to human workers, thanks to innovations in robotic manipulation, hardware optimization, and advanced AI-based sensing capabilities. The main challenges Vulcan addresses include accurately identifying among millions of products, manipulating items amid clutter, and maintaining reliability at a massive scale. The robots utilize multiple gripper types and adaptive AI models that adjust their approaches based on item properties, such as fragility, squishiness, and a tendency to entangle. Amazon has also simplified the task by pairing robots with specialized conveyors, which means that robots only need to extract items from bins rather than transporting them. While Vulcan is already being tested successfully, the goal isn’t full automation; instead, robots will handle repetitive, physically taxing tasks, freeing human workers to tackle exceptional scenarios, creating safer and more efficient warehouse operations.

Car Companies Are In A Billion-Dollar Software War & Everyone's Losing [Inside EVS]

Ford’s recent announcement to integrate its ambitious FNV4 next-generation software architecture into its existing platform highlights the significant challenges that legacy automakers face in transitioning to software-defined vehicles (SDVs). Despite investing billions, traditional manufacturers struggle to replicate the seamless, flexible, over-the-air update approach pioneered by Tesla, which centralizes software functions rather than distributing them across numerous supplier-built modules. This difficulty is exemplified by troubled rollouts, such as GM’s Vehicle Intelligence Platform, which marred the launches of the Cadillac Lyriq and Chevy Blazer EV; VW’s troubled Cariad software unit; Volvo’s delayed EX30 and EX90 models; and Ford’s setbacks, indicating widespread growing pains. The complexity arises essentially because legacy automakers must fundamentally transform their organizational cultures, which have historically focused on static, safety-first software, into agile, consumer-oriented development teams that can deliver frequent updates and intuitive interfaces without sacrificing reliability or security. Companies like GM, BMW, and Mercedes appear to be the closest among legacy brands to achieving true SDV platforms, although Japanese and Korean automakers still lag significantly. Ultimately, while startups like Rivian, Lucid, and notably Tesla remain leaders due to their clean-sheet approaches, the first legacy automaker to successfully transition from traditional hardware-centric operations to a software-driven enterprise will set the benchmark, demonstrating that, despite substantial hurdles, such a radical reinvention is achievable.

Why the Humanoid Workforce is Running Late [MIT Tech Review]

Despite investor enthusiasm, leading robotics experts express significant skepticism about the rapid commercial viability of humanoid robots. At a recent robotics expo, Daniela Rus highlighted that today’s humanoids lack essential common sense and contextual understanding, citing examples where robots execute tasks literally without interpreting human intent. Agility Robotics’ CTO, Pras Velagapudi, further outlined the fundamental challenges: humanoids require powerful batteries, robust safety measures, and complex manufacturing, all of which constrain their real-world practicality. These limitations mean that current capabilities, such as advanced hands or conversational AI, often don’t translate effectively into functional workplace tasks. The skepticism is underscored by controversies involving highly funded startups such as Figure AI, whose public claims about robot deployments at BMW faced media scrutiny over their accuracy. Despite bold market predictions, like Bank of America’s forecast of one billion working humanoids by 2050, roboticists argue that adoption will be slow, incremental, and heavily industry-specific. Historical patterns of robotics development indicate long development cycles, suggesting that widespread adoption of humanoid robots faces numerous hurdles, including nonexistent regulatory frameworks, technical limitations, and challenges in transferring successes from one sector to another.

Snowflake’s AI Automotive Data Cloud [Snowflake]

The automotive industry has undergone a dramatic transformation, shifting from mechanically complex vehicles to software-driven, cloud-connected, and increasingly autonomous machines, powered by massive data flows. Key challenges automotive companies face include overcoming siloed data across different processes, managing unprecedented volumes (over 20 GB/hour per vehicle), upgrading legacy infrastructure, and improving collaboration across complex supplier and partner networks. As the industry moves to multi-cloud environments to avoid vendor lock-in, data fragmentation persists, complicating the efficient utilization of data. To address these challenges, Snowflake has introduced Automotive Solutions within its AI Data Cloud, enabling automakers to unify structured and unstructured data from enterprise, manufacturing, and connected vehicles in a centralized, secure platform. Snowflake facilitates real-time data sharing, analytics, and AI integration across the automotive value chain, from R&D to after-sales. This unified approach enables automakers to create seamless end-to-end visibility, facilitates faster innovation, and supports new developments, such as AI-driven digital twins, fully autonomous vehicles, and personalized mobility services.

Blog / Research:

The Techno-Industrial Playbook [IFP]

The Techno-Industrial Policy Playbook argues that the United States has reached “a techno-industrial crossroads” after decades of “invent-here, make-there” complacency. It warns that at today’s capacity, “it would take at least eight years to replenish major defense inventories,” that the number of prime defense contractors has collapsed from 50 to 6, and that China now enjoys 23,000 percent more ship-building capacity while constructing 23 next-generation nuclear reactors to America’s zero. Compounding the problem, U.S. grid expansion has fallen 90 percent since 2013, even as AI-driven electricity demand surges. These indicators, the editors write, expose systemic vulnerabilities across industrial power, national security, and frontier innovation, the three pillars around which the playbook is organized.  To address this crisis, the playbook presents 27 detailed, actionable proposals from senior domain experts, offering an “all-of-the-above strategy” that combines public investment, regulatory reform, and private-sector mobilization. Highlights include launching “X-Labs” to fund high-risk science, creating Special Compute Zones and loan-office financing for advanced nuclear, redesigning NEPA to accelerate energy permitting, overhauling the Advanced Manufacturing Institutes and Small Business Administration, upgrading the Manufacturing Extension Partnership, and streamlining defense procurement to bridge the “valley of death” for new technologies. Fiscal levers range from targeted tax incentives to a modernized Strategic Petroleum Reserve, while workforce initiatives call for scaling vocational training and a “Project Paperclip 2.0” to recruit top global scientists. Together, these steps aim to restore competitive and cost-effective production at home, close critical minerals gaps, and ensure that emerging capabilities in AI, biotech, and hypersonics transition swiftly from the lab to the factory to the field.

The Future of Hardware Design: A Short Sci-fi [Futurecast]

Podcast/Video:

Jim Fan: The Physical Turing Test [Sequoia Capital]

Finance & Transactions 💵

Venture Capital:

X-Bow - A company building advanced solid rocket motors and modular boost platforms.

$105 million [Series B] - From Razor's Edge Ventures, Crosslink Capital, Balerion Space Ventures, and Capital Factory Ventures

Infinite Uptime - An Indian provider of predictive maintenance and energy efficiency software for process industries

$35 million [Venture] - Led by Avataar Ventures and joined by StepStone Group, LGVP, Tiger Global, and GSR Ventures.

Planned Downtime 🧑🔧

Stripe Sessions Conversation with Jony Ive