Breaking the Bottleneck | Issue 87

[8/4/2025] An Amazing Breakdown of the Robotic Value Chain, Skild AI, Automation in China & More!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, 2025 predictions, and more!

💥 If you are building, operating, or investing in manufacturing, supply chain, or robots, please reach out - adityabreakingthebottleneck@gmail.com I’d love to chat!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🗞️🔬 📚

News:

Building the General Purpose Robotic Brain [Skild AI]

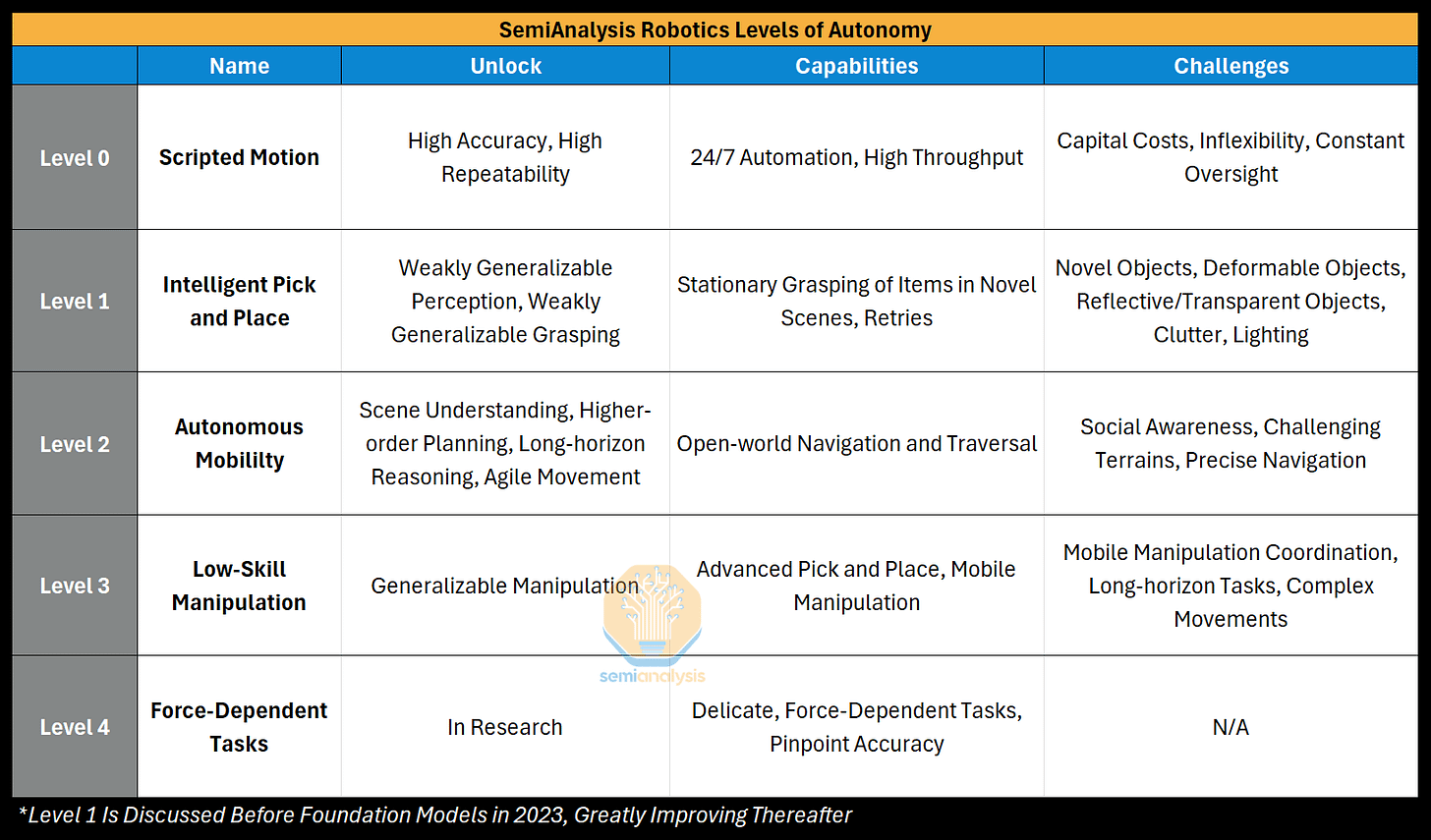

Robotics Levels of Autonomy [SemiAnalysis]

SemiAnalysis's amazing breakdown on the robotic levels of autonomy classifies the march toward general-purpose machines into five use case-anchored categories. Level 0 still rules heavy industry with scripted arms welding and painting around the clock, turning out up to 2,000 cars per day in “dark factories” that operate without lights. A new body-in-white line robot costs $10–$60 million, yet pays back in under two years and cuts unit labor by 75 percent. With these robots, integration and fencing often run four to six times the robot price, limiting adoption to capital-rich plants. Level 1 added vision for pick-and-place, yet 99 percent accuracy and $90k–$180k cells rarely beat humans who grab multiple items at once. However, uniform parcels are the exception with ten robotic arms replacing 23 workers, hitting 520 picks per hour, and beating human costs within a year despite. Next is Level 2, which is where there is a real shift in the applications and use cases performed. Here, quadrupeds stuffed with Nvidia Jetsons, LiDAR, and 90-minute batteries roam construction sites, refineries, and wind farms after just one to three weeks of setup. A single substation reported a $350k first-year uptime gain while avoiding $1 million in survey costs. Level 3 layers low-skill manipulation via vision-language-action models plus cheap overseas tele-operators, letting Robots-as-a-Service complete tasks such as folding 300 hotel towels overnight, stocking totes, or cooking pre-portioned meals and turn cash-flow positive within days. Finally, Level 4 is still research, focused on tactile sensing and force feedback for screw-driving, plumbing, and pocket searches. Mastering that final hurdle would open nearly every remaining manual task to automation, crashing labor costs, and boosting global production capacity.

How Carmakers Are The Biggest Loser from the Trade War [FT]

Detroit Axle CEO Mike Musheinesh saw monthly duties on Chinese parts shipped through Mexico jump from seven hundred thousand dollars to more than seven million after Donald Trump raised their tariff rate to 72.5 percent. He is suing to overturn the levy, calling the sudden hike an “incredible shock.” Across the sector, the pain is deeper. Stellantis, Ford, and General Motors together expect a seven-billion-dollar earnings hit in 2025. Ford already posted an eight-hundred-million-dollar quarterly loss, while Tesla booked three-hundred-million in tariff costs and warned of “tough quarters ahead.” The new trade regime is layered and shifting. Imports from Japan, the EU, and South Korea now face a 15 percent car tariff, but vehicles built in Mexico or Canada owe 27.5 percent unless fully compliant with USMCA rules. Parts that do meet USMCA escape duties, and assemblers get small rebates, yet copper, steel, and aluminum surcharges are passed through suppliers. Cox Automotive projects new-car prices will rise four to eight percent by year-end as automakers quietly trim incentives and raise financing costs, and Musheinesh has lifted part prices and kept staff, but profits remain down 80 percent.

America’s Aluminum Revival Faces a Power Problem [Canary Media]

Century Aluminum and Emirates Global Aluminium plan to build the first US primary smelters since 1980, one in Oklahoma and a still-undecided site in Kentucky or the Ohio River basin. Each plant would produce about 600,000 metric tons per year and draw as much electricity as the entire state of Rhode Island, nearly tripling domestic capacity by 2030. To be competitive, they need twenty-year clean-energy contracts priced at or below forty dollars per megawatt-hour, yet current renewable purchase agreements run fifty to sixty dollars and could rise as federal tax credits for wind and solar expire. Data-center giants willing to pay more than one hundred dollars per megawatt-hour are already outbidding heavy industry for scarce grid capacity. Century has a five-billion-dollar design that targets seventy-five percent lower emissions and a five-hundred-million-dollar DOE grant, but site selection is stalled until it secures power. EGA’s four-billion-dollar Oklahoma project is courting a special rate from utility PSO, backed by two hundred seventy-five million in state incentives and a proposal to source forty percent renewable energy. With only four US smelters still operating and tariffs on imported aluminum doubled to fifty percent, reshoring hinges on cheap carbon-free electricity and grid reforms that let smelters curb or shift load during peak demand, mirroring flexible models in Canada, Australia, and New Zealand.

Other Reads:

Shaun Edwards’ great post about how America can’t out-innovate China without mechanical engineers or robots.

A breakdown of China’s industrial AI policy to accelerate the adoption of robotics, autonomous vehicles, biotech, and public services, through both private sector innovation and state-backed infrastructure.

BCG’s breakdown on how leadership alignment with frontline teams, centered on six behavioral shifts, is critical to transforming manufacturing operations and driving adoption of digital solutions throughout the organization.

A breakdown of the concept of swarm robotics and its potential to integrate new materials, shrink capital needs, and adapt instantly to production changes in aerospace manufacturing.

Tesla signed a $16.5 billion deal to source chips from Samsung Electronics, opens new tab, a move that could bolster the South Korean tech giant's unprofitable contract business but is unlikely to help Tesla sell more EVs or roll out robotaxis more quickly.

Messe Frankfurt is launching a trade show in Atlanta between September 16-18 to tackle the issues facing advanced manufacturers.

Announcements & Launches:

CVector launches to build the brain and nervous system for industrial assets with its industrial AI agents deployed in sectors like chemicals, automotive, and energy.

Keychain extends further into the CPG and beauty manufacturing sector with its AI-powered sourcing and procurement platform.

PTC deepens its collaboration with NVIDIA, integrating Omniverse into PTC's Creo CAD and Windchill PLM systems alongside its commitment to the Alliance for OpenUSD.

Blogs / Research:

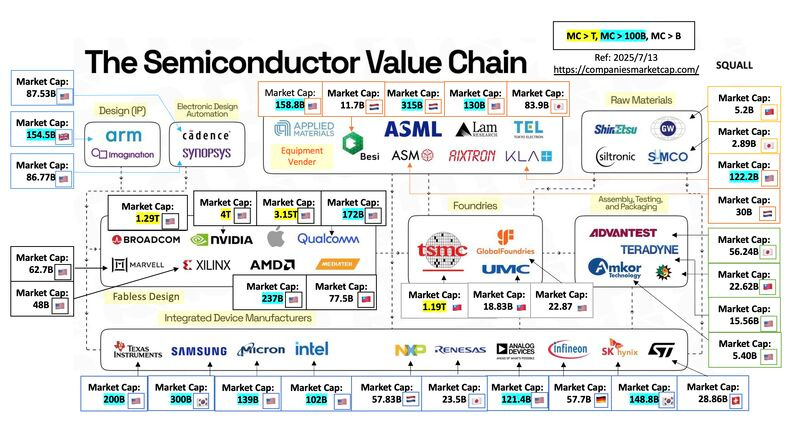

Market Map of the Semiconductor Value Chain [Chun Yi Wu]

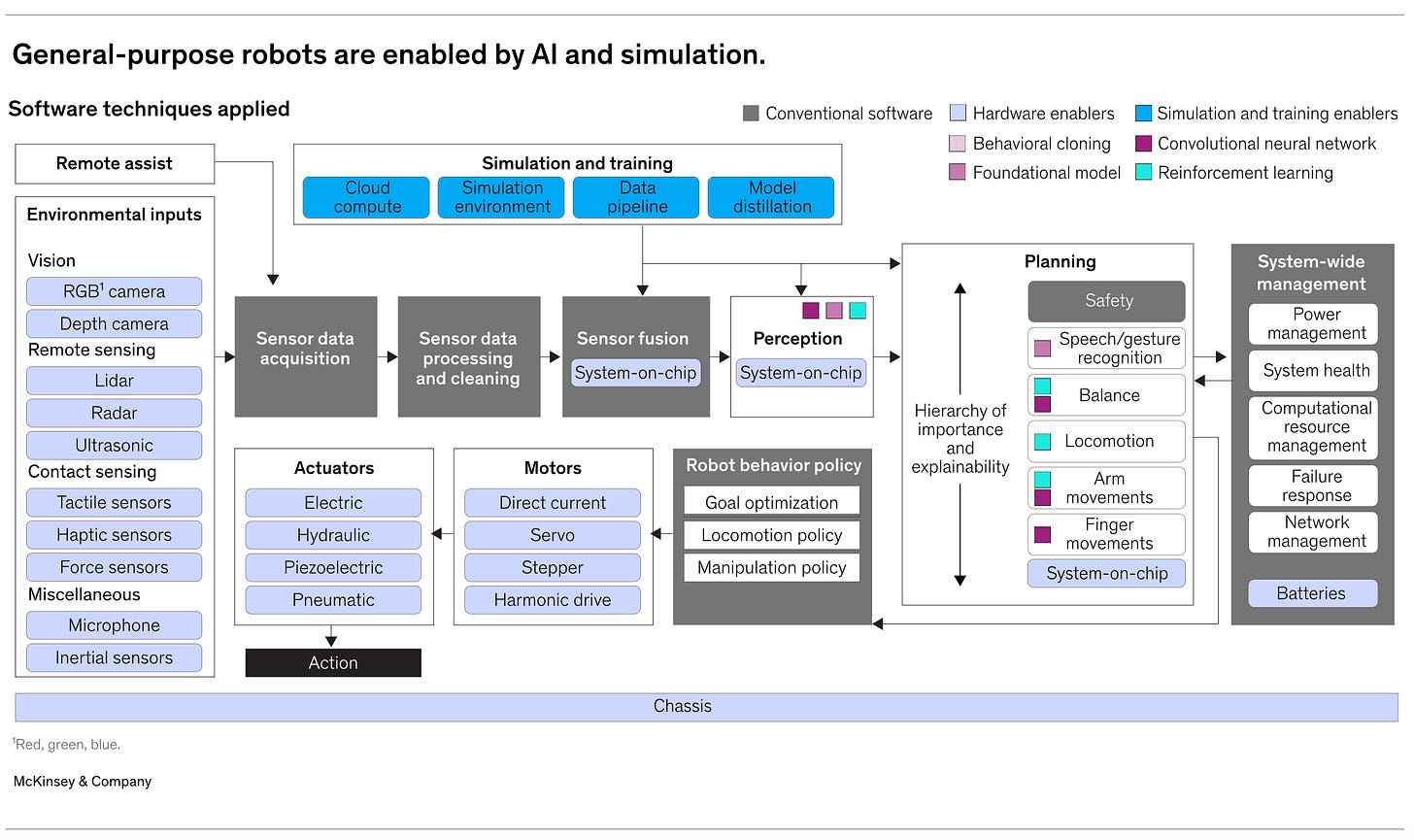

Breakdown of the Technology Behind General Purpose Robotics [McKinsey]

How Automation Is Transforming Jobs in China’s Manufacturing Sector [Inside China]

The State of Robotics, Part 2 [Joanna Licther]

Podcast/Video:

How Chinese Manufacturers Are Countering Trump’s Tariffs [Odd Lots]

The Reality of American Manufacturing [The Dividend Cafe]

Finance & Transactions 💵

Multibeam - A company that is building a multicolumn e-beam lithography market with a platform that enables rapid prototyping and production of leading-edge semiconductors.

$31 million [Series B] - Led by Onto Innovation and Lam Capital

Planet Solar - A company that is redefining solar deployment with an integrated hardware and software platform that pairs high-density, terrain-following arrays with automated installation.

$12 million [Series A] - Led by Piva Capital and joined by Breakthrough Energy Ventures and Khosla Ventures.

Planned Downtime 🧑🔧

Zane Lowe Interview with ABGT