Breaking the Bottleneck | Issue 93

[9/15/2025] WEF Physical AI, Sight Machine's Reference Architecture, Physical Intelligence's Sergey Levine on Robots & More!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, 2025 predictions, and more!

💥 If you are building, operating, or investing in manufacturing, supply chain, or robots, please reach out - aditya@machinafactory.org. I’d love to chat!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🗞️🔬 📚

One Big Thing:

Physical AI: Powering the New Age of Industrial Operations [WEF]

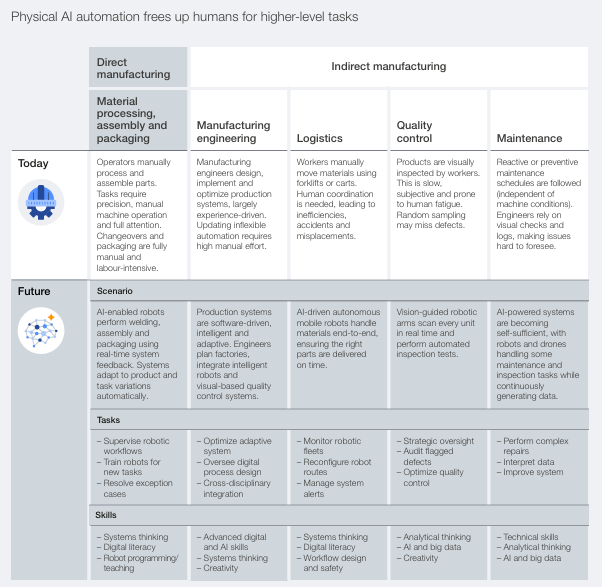

BCG and the WEF argue that industrial automation is moving from brittle scripts to systems that sense, learn, and adapt. They lay out a layered playbook: rule-based systems for repeatable precision, training-based systems that improve through simulation and reinforcement, and context-based systems that can plan and act in novel settings with few or zero-shot generalization. The real unlock is not only technical; it is economic. Virtual training compresses time to value, human-robot interfaces get simpler, and broader task coverage turns automation from point solutions into an end-to-end flow.

The early proof points are less about “can we automate this step?” and more about “can we orchestrate the whole operation?” Amazon stitches Sequoia (storage), Sparrow (AI-guided manipulation), and Proteus (AMRs) into a predictive loop. The company reports 25% faster delivery, a 25% efficiency boost, and a 30% increase in skilled roles. Foxconn virtualizes deployment with digital twins and AI-driven force and trajectory control for jobs like screw tightening and cable insertion. The results include a 40% reduction in deployment time, a 20 to 30% cut in cycle times, and a 15% drop in operating costs. The lesson is straightforward: perception, planning, and dexterity at the edge, trained in rich simulators operating in the cloud.

Scaling, in turn, demands a new stack and a new workforce. The stack spans robust hardware, edge compute, an operating system, and a coordination layer that is often ROS-based, simulation and training using synthetic data, photorealistic physics, and digital twins, and application interfaces wired into the existing operations systems, like an MES. Roles shift from line operators to robot supervisors, AI trainers, and fleet coordinators, with continuous reskilling as the norm. The winners will be the firms that align the stack, skills, and outcomes, not to shave costs, but rather to leverage robotics as a growth lever.

Other Reads:

Cadence to acquire Hexagon’s design & engineering business, including MSC software, to integrate Hexagon D&E’s renowned mechanical solvers with its electromagnetics, electrothermal, and CFD tools. Cadence will pay approximately €2.7 billion for the business. [Cadence]

Google DeepMind CEO Demis Hassabis on AI, the state of robotics models, and form factors, and Elon Musk on Optimus and the “Hands Problem”. [All In Podcast, Summit]

A breakdown from Bloomberg on the downfall of Jeep. After ousting CEO Carlos Tavares, whose price hikes and thin product pipeline “mismanaged” Jeep, John Elkann faced the bill. Net income was nearly halved by July 2024, and dealers revolted. Trump’s tariff barrage made it worse, forcing plant pauses, delaying the revived Cherokee, and piling on as much as $1.5 billion in 2025 duties, even as Elkann worked the phones from Rome to Paris to Washington. Near term, the fix is classic Detroit, put the Hemi back in Ram and roll out four refreshed Jeeps, but long term, it’s stitching together American, French, and Italian interests so a 248,000-person machine can still compete in an EV-and-tariffs world. [Bloomberg]

The Hyundai raid exposes the shortage of visas for firms bringing skilled talent with the intent to upskill our domestic workforce, with the annual cap recently under 100,000 visas with More thoughts here from Bloomberg. [WSJ]

Manufacturing, wholesale trade, and energy have slowed hiring or cut jobs due to tariffs. Manufacturing shed 12,000 jobs in August (78,000 YTD), mining lost 6,000, wholesale trade is down 32,000 this year, and BLS revisions show nearly 1 million fewer jobs in the year to March. [FT]

GE Vernova is exploring the sale of its industrial software business, Proficy, in a deal that could fetch as much as $1 billion. [Reuters]

Products and Announcements:

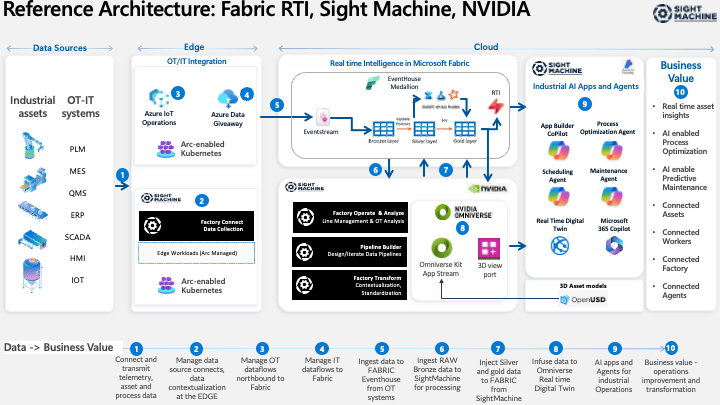

Sight Machine announces the integration of its platform, Microsoft Fabric’s Real-Time Intelligence (RTI), and NVIDIA Omniverse into a complete AI-powered solution for connecting, structuring, analyzing, and visualizing production data. [Sight Machine]

Cloud NC is launching CAM Assist 2.0, a significant upgrade to its AI solution that accelerates the CAM programming journey from CAD model to machine‑ready toolpaths, used by over 1,000 machine shops and machinists worldwide. [CloudNC]

Cognite announced a major release of Cognite Atlas AI, extending Cognite's DataOps platform to automate common operational tasks in a user-configurable, domain-specific low-code workbench. [Cognite]

Synopsys and GlobalFoundries launched a new collaboration to introduce an educational 'chip design to tapeout' program for universities worldwide.

Amazon's Zoox has announced that its robotaxi service is now available on and around the Las Vegas Strip after months of testing. [Zoox]

ASML and France-based AI company Mistral AI have established a strategic partnership to explore the use of AI models across ASML’s product portfolio, enabling it to innovate and go to market faster. [ASML]

Forrester finds that Augury’s Machine and Process Health solutions delivered a 310% ROI over three years, with payback in under six months.

Decisyon, a leading provider of AI-powered smart manufacturing solutions, announced the global launch of its Lean Manufacturing Optimizer.

Blogs:

Friday 5 | Stanislas Normand

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, 2025 predictions, and more!

Finance & Transactions 💵

Divergent Technologies - A company building the world's first end-to-end digital manufacturing platform enabling rapid design, additive manufacturing, and automated assembly.

$290 million [Series E] - From Rochefort Asset Management

ProteanTecs - An Israeli chip monitoring platform for health electronics

$51 million [Series D] - Led by IAG Capital Partners and joined by Samsung Catalyst Fund, Arm, and Siemens

Scintil Photonics - A French company focused on scaling photonics for AI factories

€50 million [Series B] - Led by Yotta Capital Partners and NGP Capital and joined by Nvidia, Bosch Ventures, and more.

Procense - A company building an AI-native industrial automation platform

$1.5 million [Preseed] - Led by HighSage Ventures

Planned Downtime 🧑🔧

Fully Autonomous Robotics Are Much Closer Than You Think [Dwarkesh Podcast]