Breaking the Bottleneck | Issue 96

[10/13/2025] Softbank + ABB Robotics, New Rare Earth Restrictions, Mapping American Machine Shops, & Bananaz + Tulip Releases!

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, 2025 predictions, and more!

💥 If you are building, operating, or investing in manufacturing, supply chain, or robots, please reach out - aditya@machinafactory.org I’d love to chat!

🏭 If you were forwarded this and found it interesting, please sign up!

Content I Enjoyed Last Week 🗞️🔬 📚

A Couple of Big Things:

Softbank and ABB Robotics Acquisition [The Robot Report]

SoftBank has agreed to acquire ABB’s robotics division for $5.4 billion in cash, bringing a business that generated $2.3 billion in 2024 revenue and employs approximately 7,000 people into its expanding robotics ecosystem. The acquisition creates a vertically integrated pipeline from compute to deployment: Arm with architecture, Nvidia and AMD supply training infrastructure, OpenAI provides AI models, ABB robots generate real-world operational data to refine those models, and SoftBank captures value across the entire stack. This positions SoftBank to compete directly with the industrial robotics “Big Four” (Fanuc, KUKA, Yaskawa) while leveraging AI capabilities none of its traditional competitors possess.

From ABB’s perspective, the sale appears strategically questionable despite the premium valuation. While robotics represented only 7% of ABB’s total revenue, the division’s timing for divestment raises concerns given the sector’s explosive growth trajectory. ABB is essentially selling a data goldmine: its installed base of nearly 500,000 industrial robots worldwide could have served as a massive real-world data collection network, generating the operational insights needed to train successive generations of increasingly intelligent robotic systems. By exiting now, ABB trades long-term optionality in the fastest-growing segment of industrial automation and may look short-sighted if Physical AI follows the explosive adoption curve of generative AI.

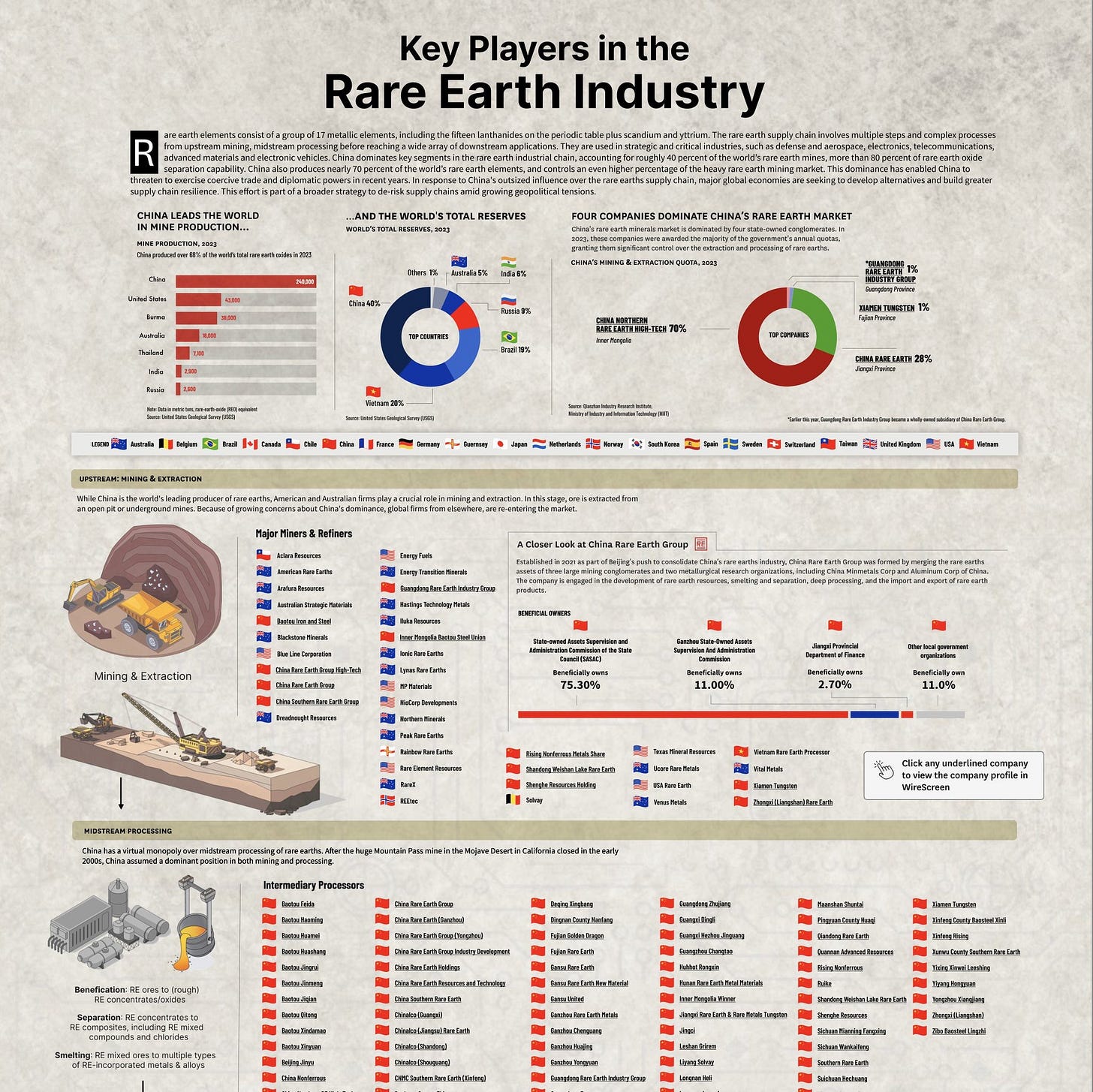

Rare Earth Restrictions and Impact [WSJ]

On Thursday, China announced restrictions on foreign entities acquiring products containing as little as 0.1% Chinese rare-earth materials or certain Chinese technologies. Given that China controls approximately 90% of global rare-earth production and critical mineral supply chains essential to EVs, defense systems (drones, missile-targeting), and electronics (see above), this will likely prove inflationary for most industrial companies in the short term. Only GM made the bold bet of investing in US-based rare earth materials in 2021 to reduce its reliance on China. As a result, GM will be the sole US automaker with American-made rare-earth magnets from multiple factories. It will be interesting to see what new contracts are struck in the coming months, specifically with companies like Mariana Materials, who are focused on domestic material production.

Other Reads:

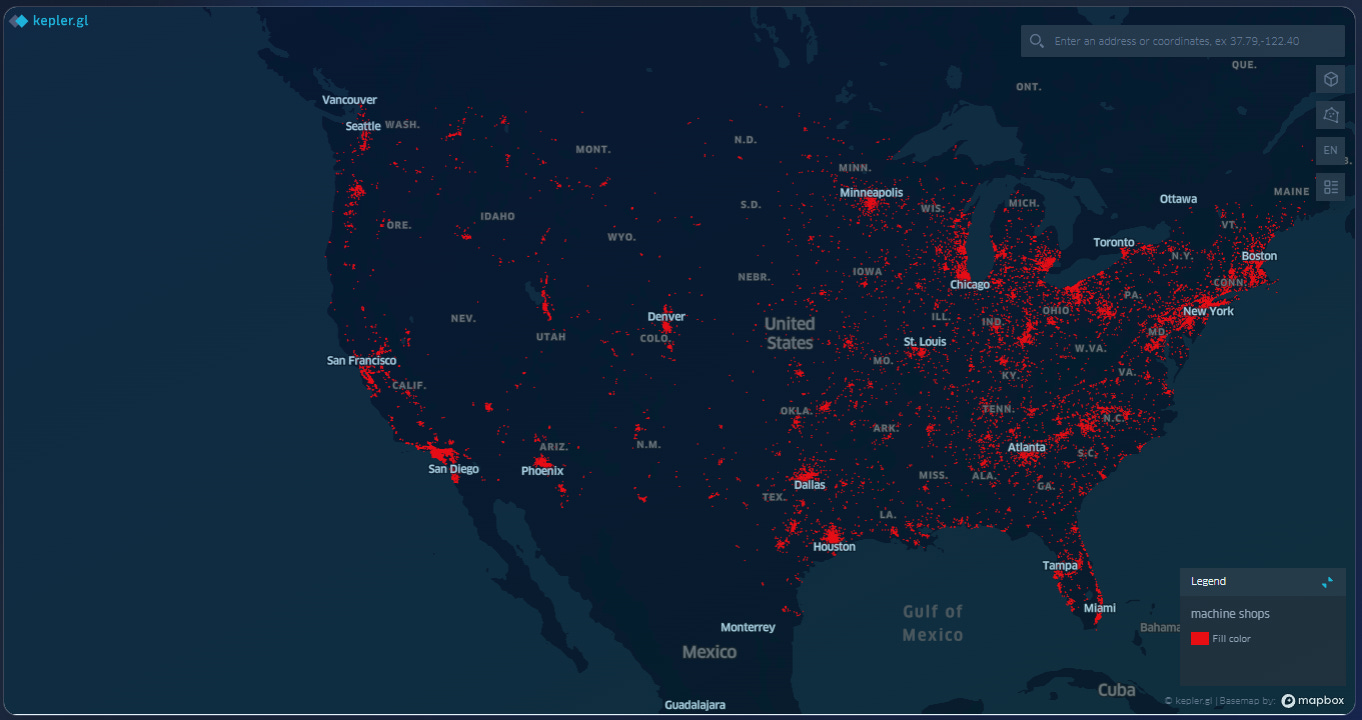

Mapping American Machine Shops [Alex Huckstepp]

Alex Huckstepp of Uptool created an interactive map of every active machine shop specializing in precision CNC milling, turning, and sheet metal manufacturing. Check it out here!

Zebra Technologies released its intelligent operations report a few weeks ago, revealing significant insights into manufacturing automation and AI adoption. Here are the key findings:

Manufacturers are allocating 69% of their IT budgets to workflow automation technologies, demonstrating a significant commitment to operational transformation.

Machine vision (80%) and AI (55%) have emerged as top priorities for quality control improvements.

AI adoption in material handling has grown substantially, increasing from 13% to 20% over just two years.

Most manufacturers are either piloting or actively using AI across critical workflows, including inventory optimization (71%), cost optimization (57%), and demand forecasting (60%).

Data infrastructure represents a significant gap, with only 11% of manufacturers having achieved fully integrated, AI-driven data management across their organizations, while 65% still operate with siloed or limited data capabilities.

Databricks has an interesting read on the revolutionizing of car measurement data storage and analysis in collaboration with Mercedes-Benz AG. The hierarchical semantic data model was developed using measurement data from 21 distinct test vehicles, for car measurement data storage and analysis, with 30,000 to 60,000 recorded signals per vehicle. This enabled rapid identification of relevant sessions and signals, drastically reducing processing time. [Databricks]

The impact of the Novelis fire in New York is becoming apparent. The facility, which supplies approximately 40% of the aluminum sheet used by the US Auto industry, produces over 350,000 metric tons annually for around a dozen automakers, including Ford, Toyota, Hyundai, Volkswagen, and Stellantis. The plant will remain offline until early next year. [WSJ]

A Bain report suggests that Humanoid success depends not just on capability development but on establishing regulatory frameworks, safety certifications, workforce acceptance, and public trust, with adoption expected in waves. First in controlled industrial environments, then in variable service environments, and finally in unstructured real-world settings, as dexterity and energy density improve. [Bain]

Collaborative robots (”cobots”) are enabling U.S. manufacturing reshoring by quadrupling per-worker productivity at companies like Ohio-based Raymath (revenue tripled with 13 cobots) and Pennsylvania’s Caltech Manufacturing (2- 4x productivity gains), helping offset China’s 2-million-plus industrial robot advantage. [WSJ]

Products & Releases:

Bananaz launched Design Agent, an AI agent engineered for mechanical logic. Powered by computer vision and advanced algorithms, it understands CAD files, learns company rules, and automates inspections, tolerance analysis, GD&T checks, and more. Check it out here! [Bananaz]

Tulip launched their next-generation operations platform with an AI Composer for Video, Agent Library, and an Agent Builder, letting you design and deploy your own agents with full access to the power and governance of the Tulip platform [Tulip]

Figure launches Figure 03 with a completely redesigned sensory suite and hand system, soft goods, wireless charging, an improved audio system for voice reasoning, and battery safety advancements tailored for the home environment. [Figure]

PTC introduced new agentic AI capabilities across its SLM solutions. ServiceMax AI and Servigistics AI are designed to make service workflows faster and easier across field service, parts management, and other service operations. [PTC]

Base Power, a company building residential battery storage systems, announced a $1B fundraise. To date, it has sold more than 100 megawatt-hours’ worth of its home storage batteries in Texas. Check out the COO,

, blog here! [Techcrunch]

Podcasts & Blogs

Interview With SVP at Aras and Former VP of SolidWorks, Igal Kaptsan

Friday 5 | Igal Kaptsan

Breaking the Bottleneck is a weekly manufacturing technology newsletter with perspectives, interviews, news, funding announcements, manufacturing market maps, 2025 predictions, and more!

When Semiconductor Manufacturing Went East and Chip Design Followed [

]Finance & Transactions 💵

Base Power - A company building the backbone of the residential energy storage market.

$1 billion [Series C] - Led by Addition and joined by CapitalG, Elad Gil, Lightspeed, Ribbit, Thrive Capital, and Valor Equity Partners.

Quilter - The first and only company to publicly demonstrate fully autonomous PCB layout through physics-driven AI.

$25 million [Series B] - Led by Index Ventures

DualEntry- A company building an AI native ERP.

$90 million [Series A] - Led by Lightspeed and Khosla Ventures and joined by GV, Contrary, and Vesey Ventures.

Katana - A company building a platform to help with inventory management, material planning, and production scheduling.

€14 million [Series B Extension] - Led by Cogito Capital Partners and joined by Northzone, Atomico, 42Cap, and Lightrock.

Tihive - A French company building industrial inspection with silicon-based terahertz imaging devices and AI.

€8 million [Seed] - From Karista, Wind, and EIC Fund

Cyberwave - An Italian company building a platform for integrating AI agents with robots.

€7 million [Seed] - Led by United Ventures

Planned Downtime 🧑🔧

A Knight of the Seven Kingdoms Teaser Trailer